Wednesday links: an awesome product

Abnormal Returns

MARCH 20, 2024

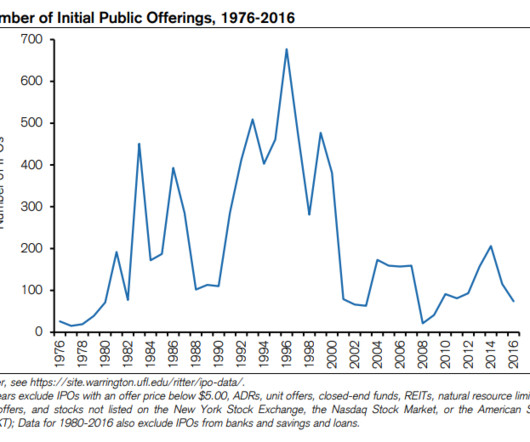

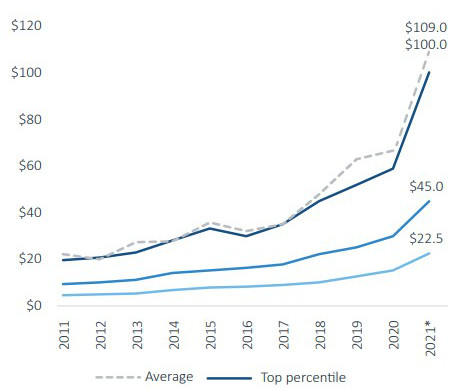

amycastor.com) Companies It's hard to wrap your head around the numbers with Nvidia's ($NVDA) new chips. marginalrevolution.com) Finance Private equity is stuck between elevated valuations high interest rates and a moribund IPO market. variety.com) Streaming is so complicated that it needs a startup to help consumers navigate it.

Let's personalize your content