Can 'Magic Numbers' Boost Charitable Donations?

Wealth Management

SEPTEMBER 20, 2023

DAF startup Daffy recently experienced a jump in activity after embracing the significance of the number 18 in Jewish culture.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Wealth Management

SEPTEMBER 20, 2023

DAF startup Daffy recently experienced a jump in activity after embracing the significance of the number 18 in Jewish culture.

Abnormal Returns

FEBRUARY 26, 2024

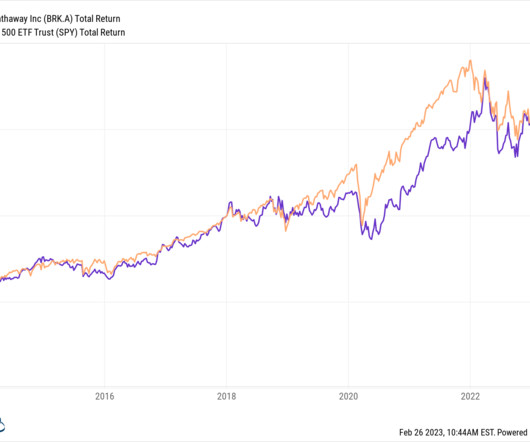

2023 numbers. safalniveshak.com) Venture capital India's most valuable startup, Byjus, is a hot mess. axios.com) A growing number of unicorns haven't raised capital in over three years. (obliviousinvestor.com) Berkshire Hathaway A closer look at Berkshire Hathway's ($BRK.A)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harness Wealth

FEBRUARY 26, 2023

Many of the insights below are ones that are understood well by second or third-time founders or startup veterans, who learned about these specific tax provisions from experience and are ready to implement them when they start their subsequent ventures. More on this below. FMV per share at time of vesting $10.00 $10.00

Harness Wealth

APRIL 17, 2023

Equity compensation is a popular strategy used by startups to attract and retain top talent, and it can sometimes result in significant financial rewards for founders and employees alike. Pros and Cons of Tender Offers for Startup Employees Personal Financial Planning Considerations Frequently Asked Questions What is a Tender Offer?

Harness Wealth

FEBRUARY 7, 2023

If you’re a startup employee, chances are you earn stock options or grants as part of your compensation package. Startups typically follow a three to four year vesting schedule, with shares gradually being distributed monthly after one full year on the job (that one-year mark is known as the cliff).

Harness Wealth

FEBRUARY 27, 2023

Founders, board members, and employees of startups that get acquired can experience tax consequences as a result of a liquidity event. It’s imperative to plan for the tax implications so you can be prepared to pay what you owe the IRS. Would you be willing to move to a state with lower taxes? Particularly relevant in 2020.)

Abnormal Returns

OCTOBER 3, 2023

theguardian.com) Skip Michael Lewis' new book and instead read Zeke Faux's "Number Go Up." ft.com) When is a startup no longer a startup? (ofdollarsanddata.com) Michael Lewis Some questions about Michael Lewis' relationship with SBF. coindesk.com) A profile of Michael Lewis and his typical approach to his book subjects.

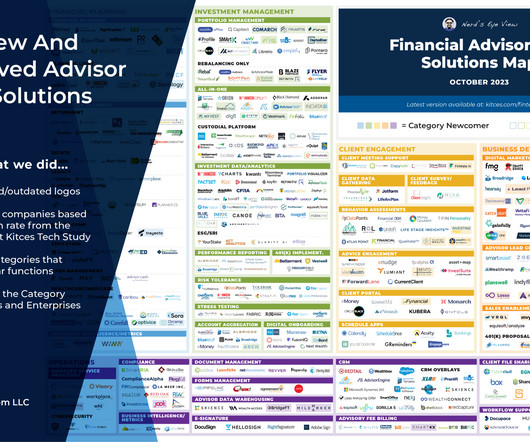

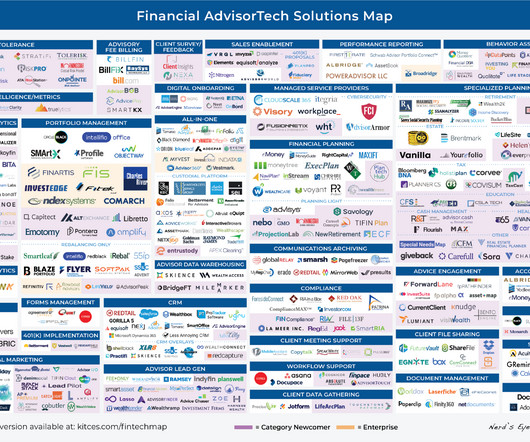

Nerd's Eye View

MARCH 4, 2024

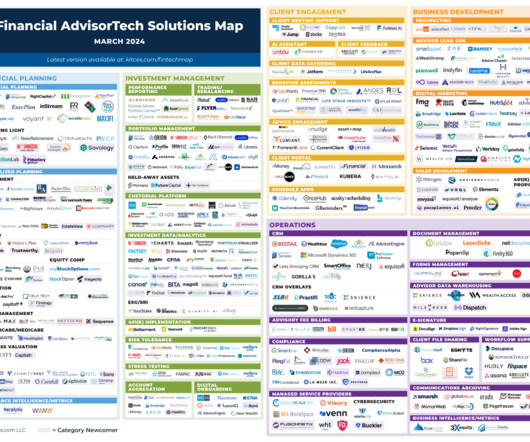

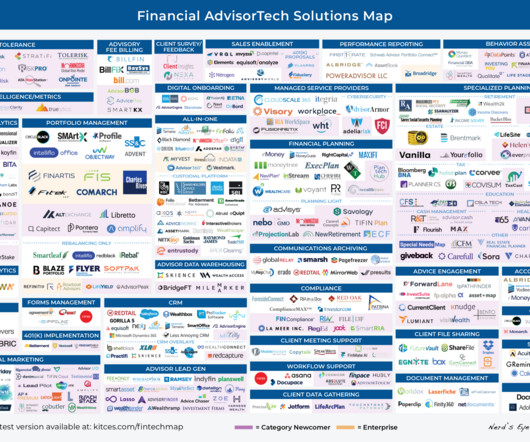

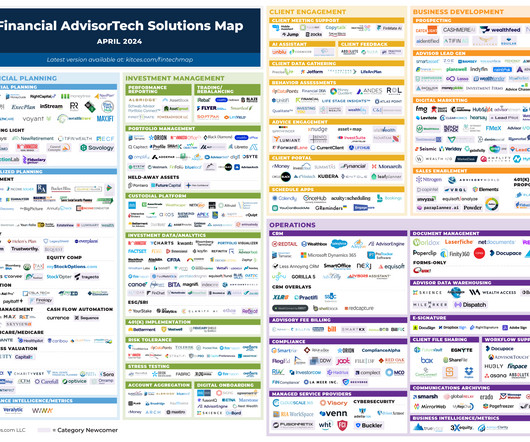

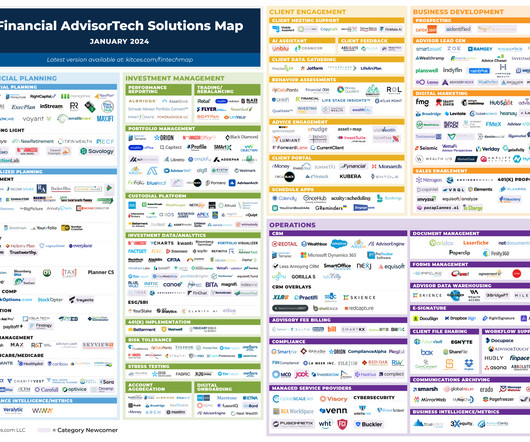

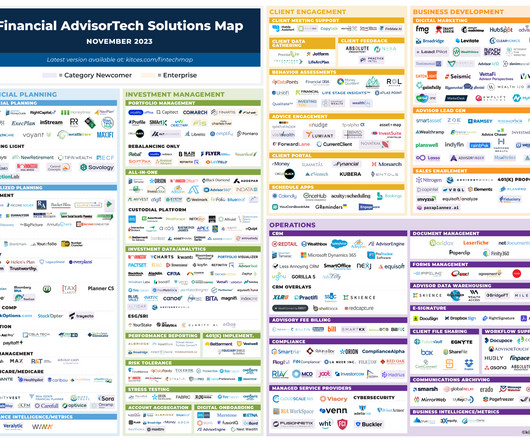

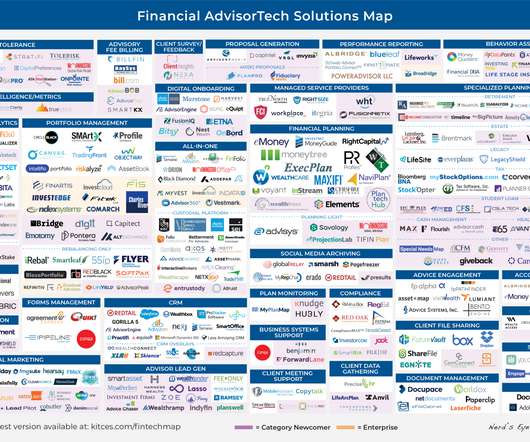

This month's edition kicks off with the news that advisor lead generation platform Datalign Advisory reached nearly $15B in referred client assets (and almost $3B in actually-converted assets) in just its 2nd year of business, as advisor demand for paid leads continues to rise (especially with Datalign's flat-fee one-advisor-per-lead model)… (..)

Abnormal Returns

APRIL 7, 2023

caia.org) Startups have shifted to capital efficiency. ft.com) Why health care startups often use human names. bonddad.blogspot.com) The ISM services number is in steep decline. (axios.com) VC VC funding fell sharply in Q1 2023. news.crunchbase.com) VCs are holding onto their cash.

Abnormal Returns

MARCH 20, 2024

amycastor.com) Companies It's hard to wrap your head around the numbers with Nvidia's ($NVDA) new chips. variety.com) Streaming is so complicated that it needs a startup to help consumers navigate it. (capitalspectator.com) Crypto Promises of a lower expense ratio are not preventing outflows from the Grayscale Bitcoin Trust ($GBTC).

Abnormal Returns

JULY 6, 2023

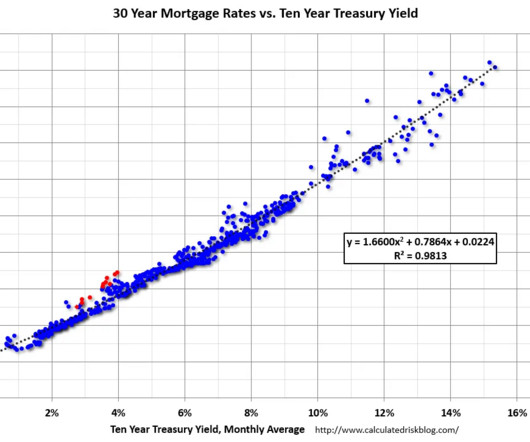

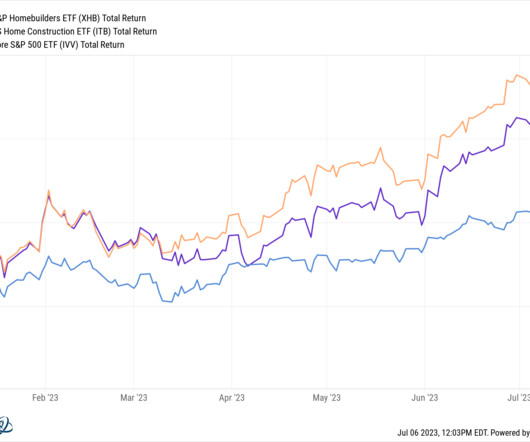

nytimes.com) Venture capital AI startups continue to gain venture interest. ritholtz.com) 30-year mortgage rates are now well over 7.0% (cnbc.com) Global There is a boom in the number of space-related startups in India. Crypto What changed Blackrock's idea about crypto?

Nerd's Eye View

SEPTEMBER 4, 2023

This month's edition kicks off with the news that WiserAdvisor, one of the longest-running lead generation services in the industry, has acquired IndyFin, a startup advisor rating platform that had aspired to be the 'Yelp for Advisors' – which on the one hand provides WiserAdvisor with an opportunity to jump into the business of client reviews (..)

Nerd's Eye View

APRIL 1, 2024

Advyzon and Panoramix competing against Orion)… with the question of whether they, too, will someday raise their prices as they gain traction as well? Advyzon and Panoramix competing against Orion)… with the question of whether they, too, will someday raise their prices as they gain traction as well?

Abnormal Returns

FEBRUARY 27, 2023

axios.com) Job number one for CEOs is capital allocation. capitalgains.thediff.co) Startups How increased regulatory risk is affecting startup valuations. theinformation.com) What makes for a great startup name. (wsj.com) Taxes on share buybacks are a speed bump.

Abnormal Returns

MAY 21, 2023

businessinsider.com) AI is moving so fast, fintech startups are having to quickly pivot. newsletter.abnormalreturns.com) Mixed media A growing number of New York City office buildings are emptying out. finance.yahoo.com) Why a sizable number of native Hawaiians have moved to Las Vegas. nytimes.com)

Abnormal Returns

DECEMBER 3, 2023

ft.com) Do startups founded in recessions fare better? downtownjoshbrown.com) College-educated women with children under 10 are in the workforce at record numbers. (wsj.com) The inside story of Microsoft's ($MSFT) partnership with OpenAI. newyorker.com) Venture capital More VC funds are running out time while still holding investments.

Harness Wealth

JANUARY 24, 2023

QSBS recognition for startup founders If you’re a startup founder, one of the most important tax considerations for you will be Qualified Small Business Stock (“QSBS”) Recognition. Who knows, you might even find a more tax-friendly destination along the way.

Abnormal Returns

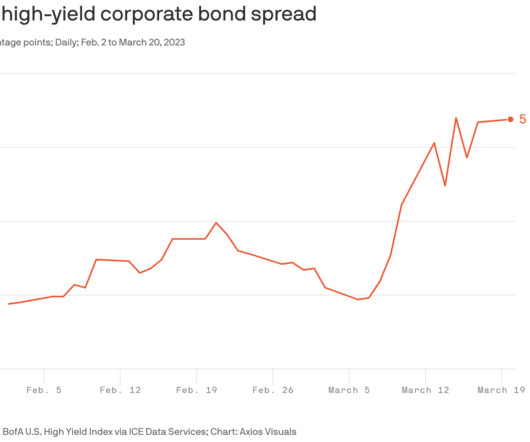

MARCH 21, 2023

youtube.com) Credit Suisse was also a player in the startup financing space. huddleup.substack.com) Baseball is getting its own 'Topgolf' style startup. frontofficesports.com) By the numbers: which countries like baseball the most. news.crunchbase.com) Banks still have a big problem. vox.com) Of course we should ban TikTok.

The Big Picture

NOVEMBER 4, 2023

Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Adam Neumann Wounded WeWork, an Office Market Bust Finished It Off : Once the country’s most-valuable startup, the flexible-workspace company is expected to file for bankruptcy. But it’s not clear why these seas exist at all.

Nerd's Eye View

NOVEMBER 28, 2023

We also talk about how Peter started in the industry in New York city in the aftermath of 9/11 as an insurance salesperson charged with cold-calling potential customers (and how he took inspiration from the work of author Nick Murray to overcome the challenge of hearing "no" from prospective clients on a regular basis and push through to grow his book (..)

Abnormal Returns

FEBRUARY 26, 2023

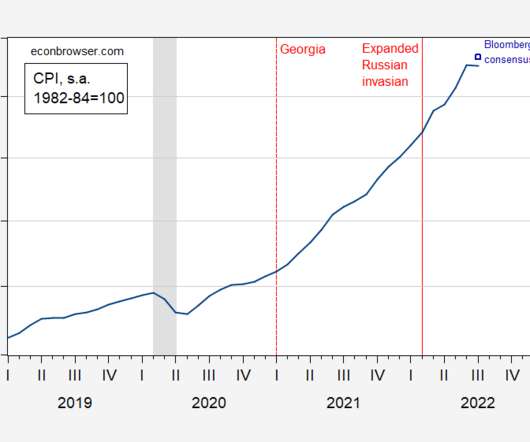

institutionalinvestor.com) Amazon Amazon ($AMZN) is increasing the number of same-day shipping options. forbes.com) The pros and cons of a four-day workweek for startups. theatlantic.com) Economy Menzie Chinn, "Strong labor market, spending and income numbers all suggest no recession in place yet."

Abnormal Returns

AUGUST 10, 2022

financial-planning.com) Startups Investors are stepping up to fund BeReal. axios.com) Startups are engaging companies to help facilitate layoffs. thereformedbroker.com) Nominal consumer debt numbers only make sense it relation to the ability to pay. theinformation.com) A look at recent major digital media exits.

Abnormal Returns

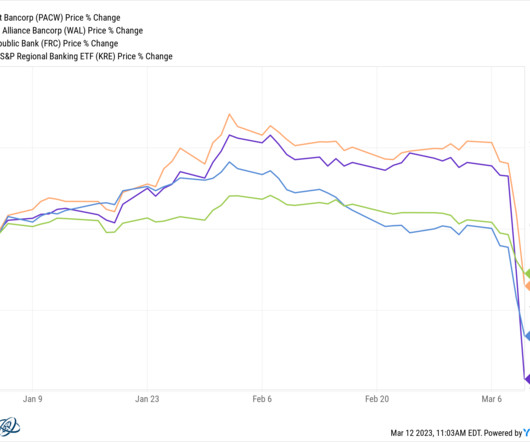

MARCH 12, 2023

thebasispoint.com) Health and biotech startups also have big exposure to SVB. theconversation.com) Firearms are the number one cause of death for U.S. (riabiz.com) Venture capital Silicon Valley Bank played a key role in the venture ecosystem. om.co) VC-backed companies are scrambling to shift funds among banks.

Abnormal Returns

MARCH 13, 2023

riabiz.com) Wealth management startup Masttro raised $43 million to address family offices. citywire.com) This is in part due to the rapid growth in the number of new RIAs. (papers.ssrn.com) The biz What will become of SVB's Boston Private wealth management arm?

Nerd's Eye View

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

NOVEMBER 6, 2023

This month's edition kicks off with the news that Practice Intel has launched a new "growth platform" centered around quantifying the quality of an advisor's client relationships with an all-in "Relationship Quality Index" (RQI) – which while potentially valuable in helping advisors understand and improve their client experience (and subsequently (..)

Abnormal Returns

DECEMBER 22, 2022

huddleup.substack.com) SpaceX alumni are building a host of space-related startups. newsletter.abnormalreturns.com) Mixed media A record number of shows were produced in 2022 and why it may represent 'peak TV.' (nytimes.com) How the success of United Wholesale Mortgage ($UWMC) made the $4 billion purchase of the Phoenix Suns possible.

The Big Picture

JANUARY 19, 2024

My end-of-week morning train WFH reads: • Americans are actually pretty happy with their finances : By the numbers: 63% of Americans rate their current financial situation as being “good,” including 19% of us who say it’s “very good.” Business Insider ) • How does the Fed control interest rates?

Abnormal Returns

JULY 18, 2022

protocol.com) The rapid grocery startup space is in full retreat. nytimes.com) Covid did a number on global childhood vaccinations. (theinformation.com) Giving out stock-based compensation is tougher when stock prices are in free fall. wired.com) Global Covid and the war in Ukraine remain as two big wild cards for the global economy.

Nerd's Eye View

OCTOBER 2, 2023

This month's edition kicks off with the news that custodial platform Altruist is eliminating the $1 per account monthly fee for its portfolio management and reporting technology for advisors on its platform, which on the one hand suggests that the economies of scale Altruist has achieved in the wake of its move to become a fully self-clearing custodian (..)

The Big Picture

MAY 5, 2023

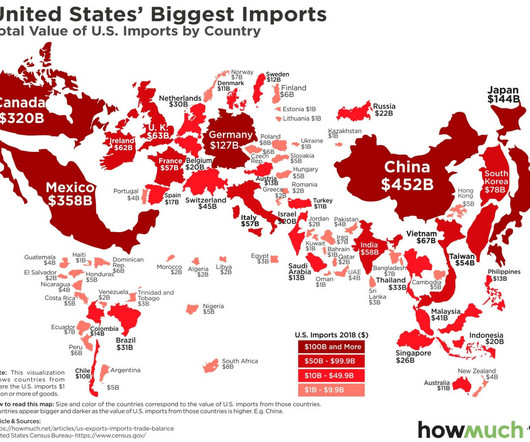

This company is betting yes : A growing number of employers around the country have decided to build their own housing for workers, mostly for them to rent but sometimes to buy. Businessweek ) • Would you live next to co-workers for the right price? But it’s still No. 1 by a long distance. Bloomberg ) • What the U.S.-China

Nerd's Eye View

NOVEMBER 15, 2023

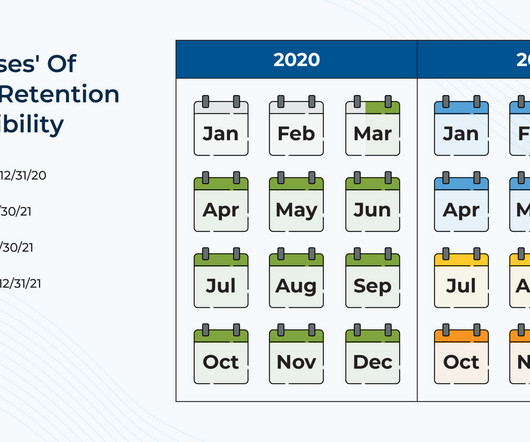

government designed a number of small business relief packages to incentivize companies to keep workers on their payrolls. To stave off a wave of business closures and a subsequent surge in unemployment, the U.S.

Nerd's Eye View

NOVEMBER 7, 2022

As with Altruist, the ‘other’ new startup RIA custodian to launch in recent years, Entrustody is pledging to have a more modern interface with a better user experience, more and deeper integrations, and a more transparent price structure than ‘traditional’ custody services.

The Big Picture

NOVEMBER 21, 2023

A Wealth of Common Sense ) • A record number of $50 bills were printed last year. Gerstner began as an entrepreneur and has had multiple exits, including travel startup NLG (to IAC). why are you seeing more $50s? The tech-focused fund started in 2008 and invests in both public and private firms.

The Big Picture

AUGUST 7, 2023

My back-to-work morning train WFH reads: • The Pandemic Small-Business Boom Is Fueling the US Economy : Startup registrations remain 42% ahead of 2019 levels, with growing numbers of companies founded by women and minorities.

Abnormal Returns

JULY 14, 2022

How startup can help fill the gap. washingtonpost.com) Wealth inequality is showing up in the number of middle class neighborhoods. (gq.com) Longreads New weight loss drugs from Novo Nordisk ($NVO) and Eli Lilly ($LLY) are game changers but come along with a lot of questions.

Nerd's Eye View

OCTOBER 19, 2022

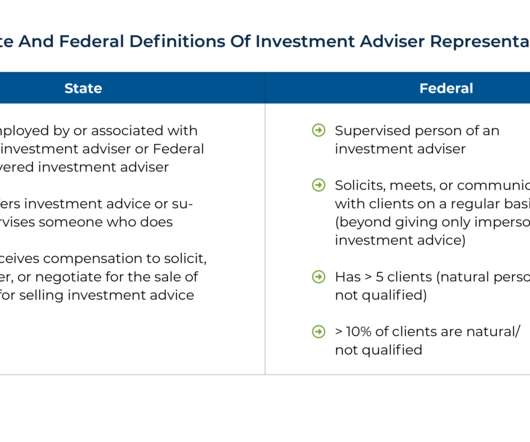

State-registered firms generally must have at least one IAR registered in each state where the firm itself is registered, and SEC-registered firms need only register IARs who work with a certain number of clients.

Nerd's Eye View

JUNE 13, 2023

In this episode, we talk in-depth about how a state regulator audit of Danika’s former firm revealed that she was not properly registered with the state of Washington and sparked an investigation during which she was prevented from working with her clients at the time and sidelined her for several months, how, on top of not being able to work (..)

Abnormal Returns

JULY 29, 2023

nytimes.com) Energy Startup Fervo Energy has demonstrated a viable geothermal energy system. modernfarmer.com) Herbal supplement Kratom is blamed for causing a number of deaths. (wsj.com) Transport Five ways the U.S. car buying experience has changed. wsj.com) There is a shortage of truck parking spots.

Nerd's Eye View

AUGUST 7, 2023

This month's edition kicks off with the news that estate planning platform Wealth.com has launched Ester, an AI-driven 'legal assistant' that uses machine learning to help advisors quickly review and extract the key information from clients' estate planning documents, as it joins FP Alpha in the competition to become 'Holistiplan for estate planning (..)

Trade Brains

DECEMBER 13, 2023

India’s IPO market has made a strong comeback this year, making it the global leader in the number of IPOs so far in 2023 and attracting investors to take advantage of the renewed interest in public offerings on Dalal Street. What do the numbers tell about IPOs? Is India experiencing an IPO boom? What does this indicate?

Abnormal Returns

AUGUST 27, 2022

which operates Pilot and Flying J travel centers, is buying a stake in autonomous truck startup Kodiak Robotics Inc. papers.ssrn.com) Putting some numbers on the effect of employer vaccine mandates. (bloomberg.com) Why people continue to drive on suspended licenses. curbed.com) Transport Pilot Co., Tax private jet travel.

Darrow Wealth Management

JUNE 2, 2022

A simple example: a startup raises a Series B at a $30M post-money valuation and a Series C at a $20M post-money valuation. Working for a startup involves risk. After a record-setting number of IPOs last year, the average newly public company is down almost 50% over the past year (Renaissance IPO ETF). Startups also need cash.

Trade Brains

AUGUST 13, 2022

Startups are not far behind as well. Startups that have lately sprung up in the electric two-wheeler space have taken a lead against incumbents. It is backed by Hero MotorCorp which holds around a 32% stake in the startup. the OEM is also working on an affordable e-scooter, which is expected to bring in more numbers.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content