Top clicks this week on Abnormal Returns

Abnormal Returns

MARCH 3, 2024

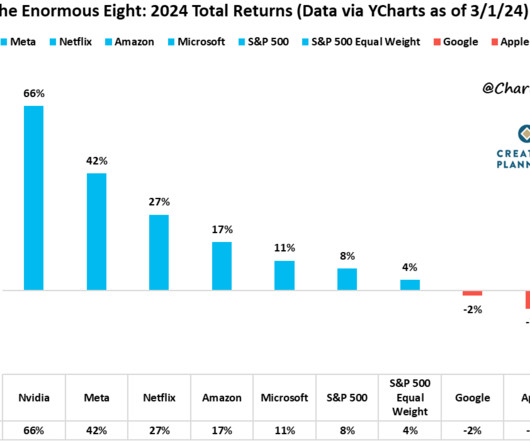

Also on the site Five thoughts on the power of letting go. (abnormalreturns.com) Top clicks this week What happens when you invest right before a bear market? (awealthofcommonsense.com) Solana is at new all-time highs. (allstarcharts.com) Consumer Reports' top ten list for 2024 is filled with hybrids. (cnbc.com) The Magnificent Seven is all anybody can talk about in the U.S.

Let's personalize your content