How to Determine Your Client’s Risk Capacity

BlueMind

SEPTEMBER 11, 2022

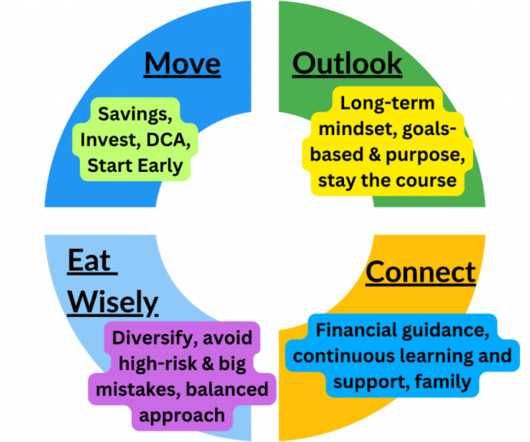

Category: Clients Risk. Determining the risk profile is essential so that you may construct a feasible financial strategy for your client’s goals. However, it should be well understood that a client’s financial profile includes their risk tolerance and their risk capacity. However, risk capacity is a numbers game.

Let's personalize your content