The 5 Pillars of Retirement Planning You Should Be Aware of

WiserAdvisor

MARCH 13, 2024

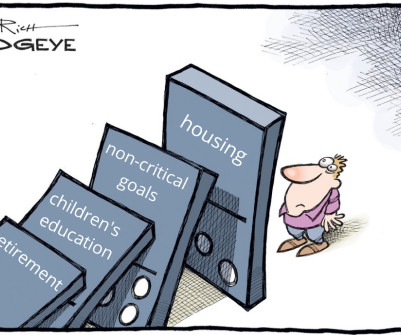

Within this framework, the concept of the five pillars of retirement planning emerges as a valuable strategy. These pillars provide a comprehensive framework for building a resilient and sustainable plan. Pillar 4: Estate planning Estate planning is often overlooked and deferred as an end-of-life task.

Let's personalize your content