Fundamental Analysis Of Waaree Renewable Technologies

Trade Brains

NOVEMBER 17, 2023

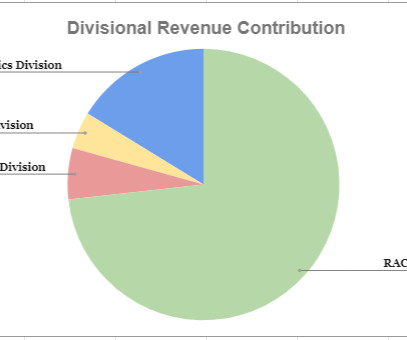

2019-20 5.68 -3.18 As we know from the data of previous years the margins are not stable due as their earnings were dependent on the number of contracts. Financial Year Debt to Equity Interest Coverage 2022-23 0.46 Net Profit (Cr.) 2022-23 350.96 2021-22 161.5 2020-21 12.98 -2.37 2018-19 7.04 -1.87 in FY22 to 0.46

Let's personalize your content