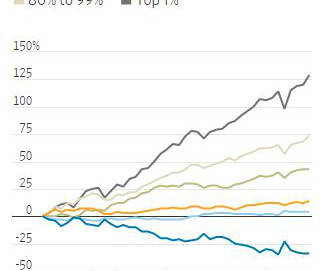

Wealth Inequality Starts at the Top

The Big Picture

JUNE 22, 2023

Source: FRED Wealth disparities get ever more lopsided the higher up the economic strata you climb; there is more disparity with the top 1% than the top 10%, but the biggest spreads are at the top 0.1% (and above). Consider the chart at top, created by Invictus via FRED. And, it has accelerated over the past few decades.

Let's personalize your content