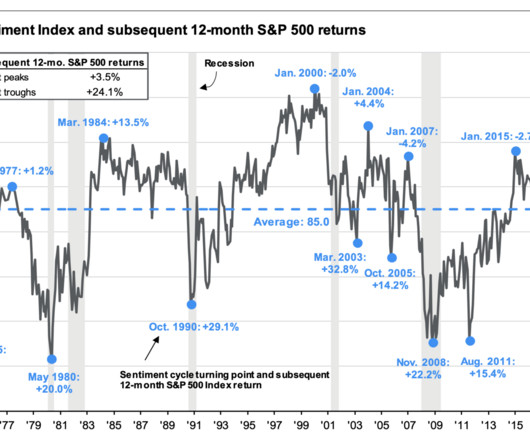

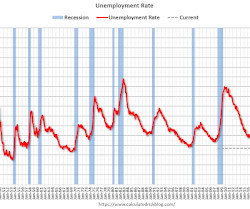

Where is This Rally Going?

The Big Picture

NOVEMBER 2, 2023

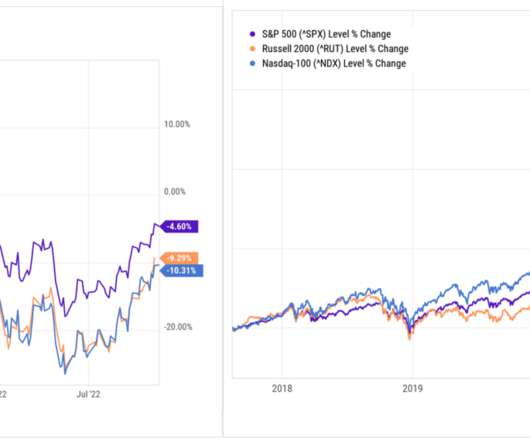

The Pandemic crash and rally was a 34% reset and a continuation of the bull that formally began in March 2013. Not So Fast (April 3, 2020) Redefining Bull and Bear Markets (August 14, 2017) Secular market cycles reflect geo-political, economic and technological issues of era (November 15, 2014) Is the Secular Bear Market Coming to an End?

Let's personalize your content