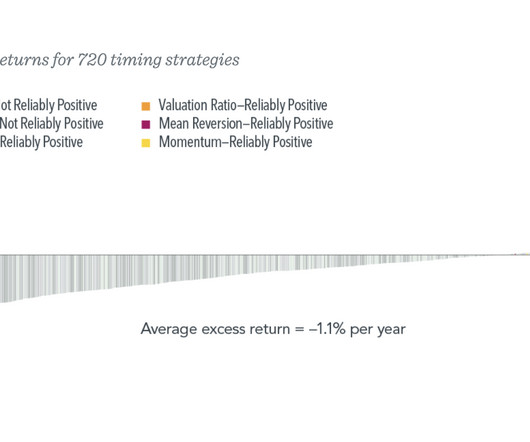

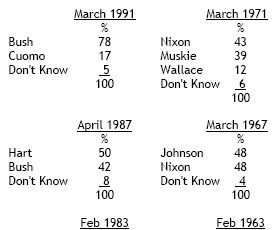

The “Art” of Market Timing

The Big Picture

NOVEMBER 27, 2023

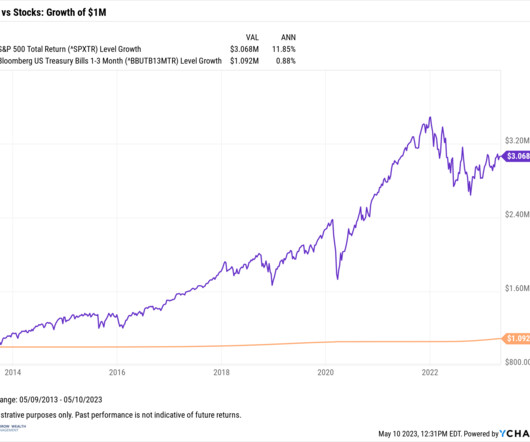

The dotcom top, the double bottom in Oct 02-March 03; the highs in 2007, the lows 2009. 24, 2023 _ 1: In particular, why average outperforms over the long run; Sommers credits not making errors (via Charlie Ellis’ “Winning the Loser’s Game”) but the nuance and math are fascinating. By Jeff Sommer New York Times, Nov.

Let's personalize your content