Is It Time to Back Away from Big Tech?

Advisor Perspectives

APRIL 4, 2024

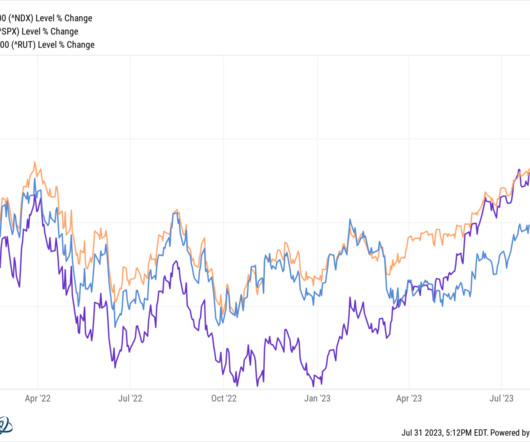

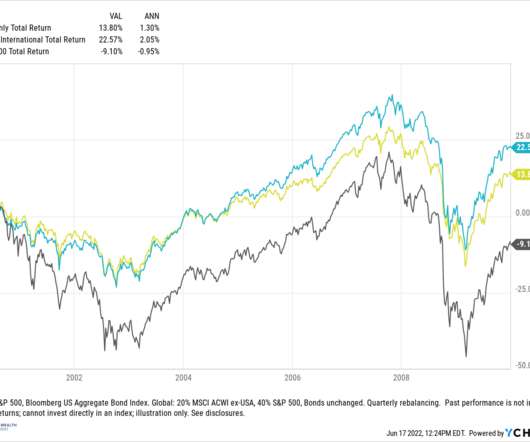

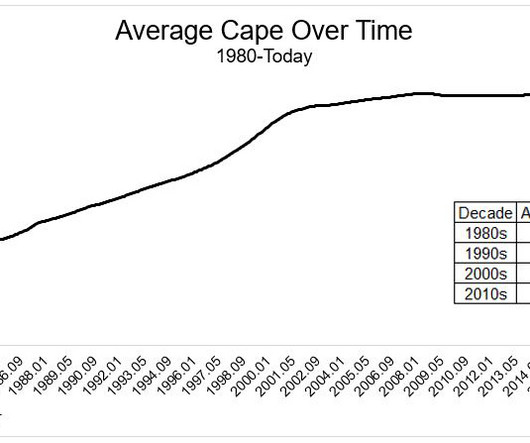

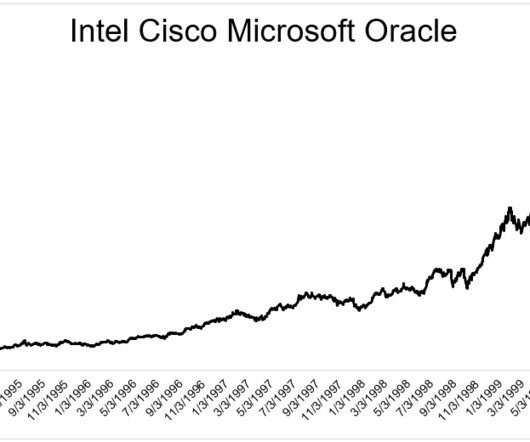

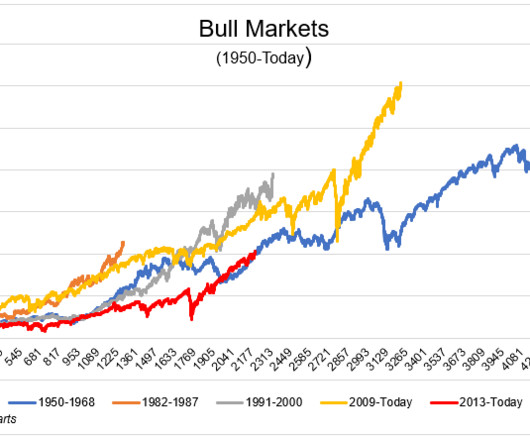

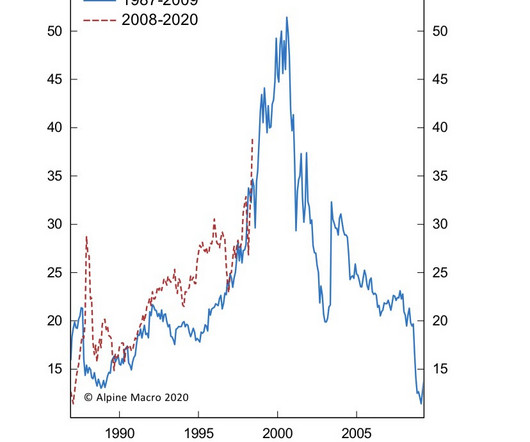

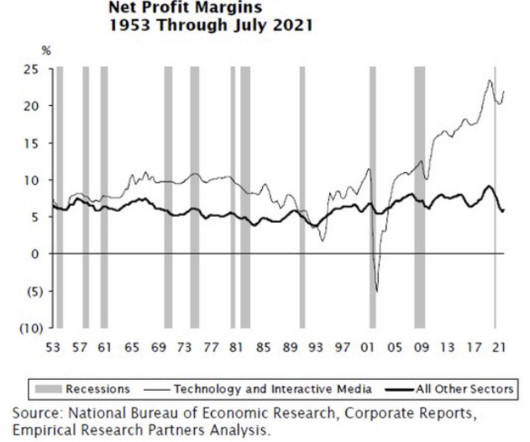

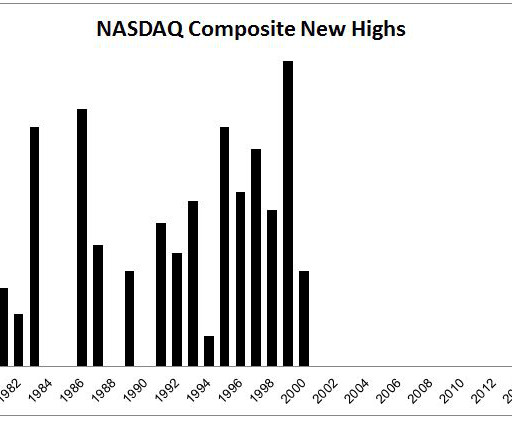

The economy, inflation, interest rates and market valuations drive the key questions facing advisors. Does the tech stock landscape mirror the boom of 1996 or the bust of 2000? What will be the impact of Meta's inaugural dividend payment? Is now the time to increase allocations to international Markets?

Let's personalize your content