Transcript: Tom Hancock, GMO

The Big Picture

FEBRUARY 6, 2024

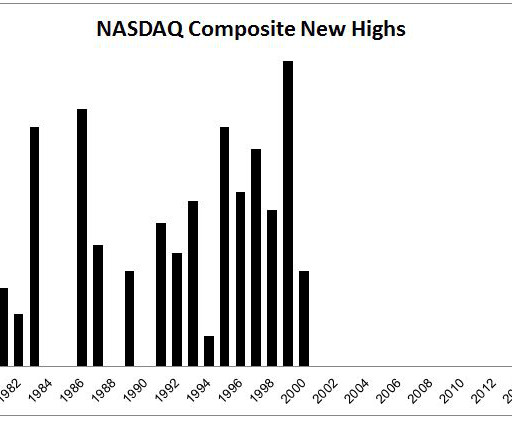

I’d say management consulting is any of the other thing that least at that time was the other career trajectory, just my personality, more of a math oriented introvert. In 2000, right. But in extremis, which is the Microsoft and the Tonight 2000 example and maybe some other AI related stocks today, it really does matter.

Let's personalize your content