Two Most Important Fundamentals for Sector/Theme Investing

Truemind Capital

JANUARY 22, 2024

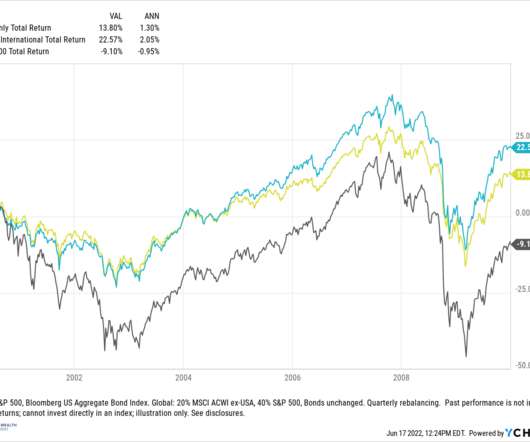

Valuation/Prices at which you invest (the difficult part) Now, if you do some thorough research and gain some insight to feel confident about better future growth prospects of any particular sector/theme you can still lose a significant amount of money or get poor returns even if your understanding was right. Let me share two examples: 1.

Let's personalize your content