Reasons to Include International Investments in Your Portfolio

Darrow Wealth Management

JUNE 27, 2022

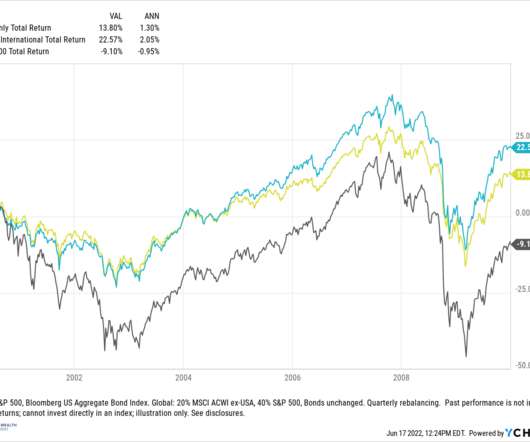

stocks that started in the early 2000s. Between 2000 – 2009, the cumulative total return for the S&P 500 was negative 9.1% Since trying to time regime changes is very difficult in real time without the benefit of hindsight, there are reasons to consider allocating both U.S. equities to an asset allocation.

Let's personalize your content