Reasons to Include International Investments in Your Portfolio

Darrow Wealth Management

JUNE 27, 2022

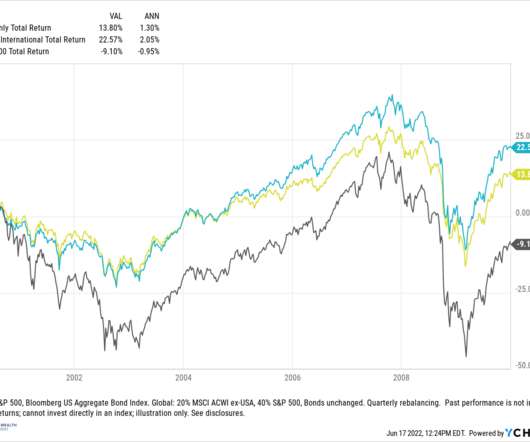

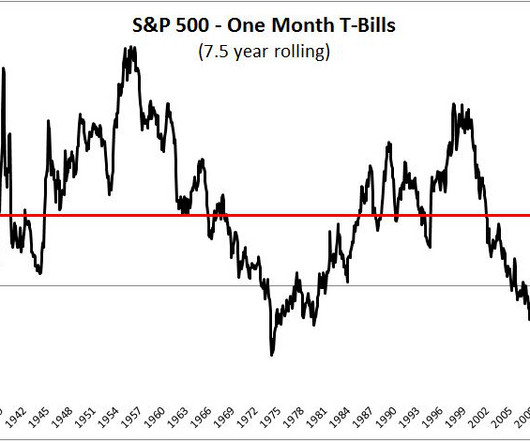

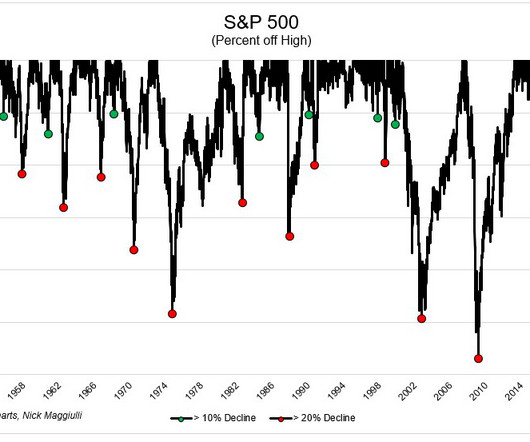

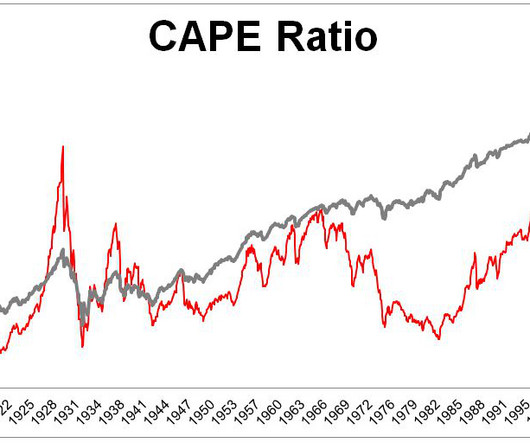

stocks that started in the early 2000s. Between 2000 – 2009, the cumulative total return for the S&P 500 was negative 9.1% equity may be able to help reduce risk in a portfolio. By way of example, consider this hypothetical 60/40 portfolio of stocks to bonds. Valuations. These bouts can be significant.

Let's personalize your content