After the recent run-up, a good time to diversify

Nationwide Financial

JUNE 14, 2023

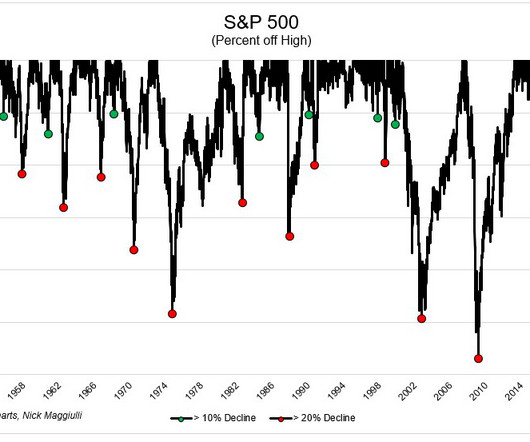

Clients participating in this year’s tech-stock rally could benefit from a portfolio review and diversification check, as this appreciation may have thrown many allocations off balance. Investors may find opportunities at more reasonable valuations when comparing different asset classes across the market.

Let's personalize your content