Tuesday links: ironclad proof

Abnormal Returns

APRIL 9, 2024

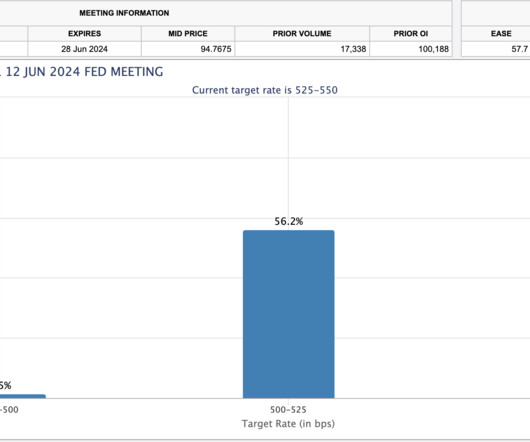

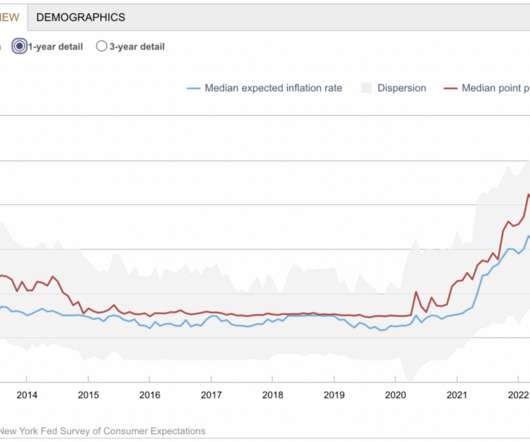

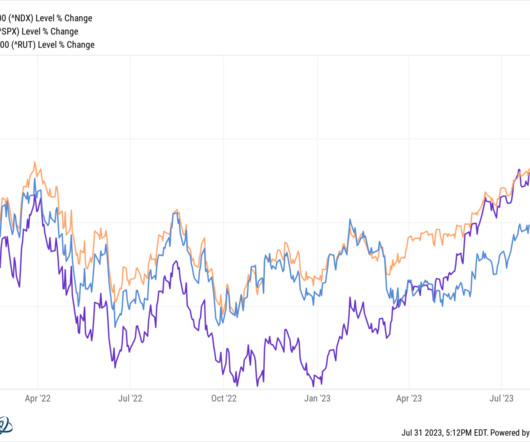

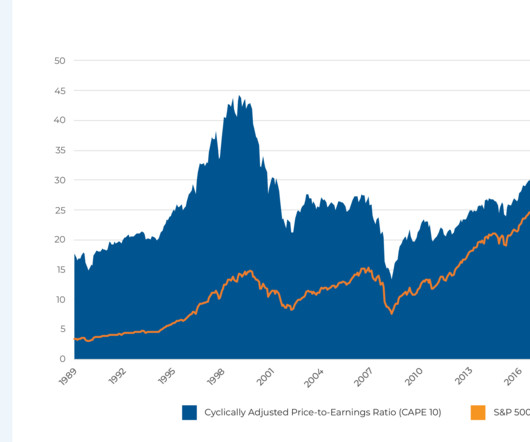

Markets Investors are coming to terms with higher short-term interest rates. barrons.com) The rise in Bitcoin has caused some long term holders to sell. construction-physics.com) Good luck trying to repurpose a movie theater for other uses. cnbc.com) Global Japan is trying to rebuild its chip manufacturing sector.

Let's personalize your content