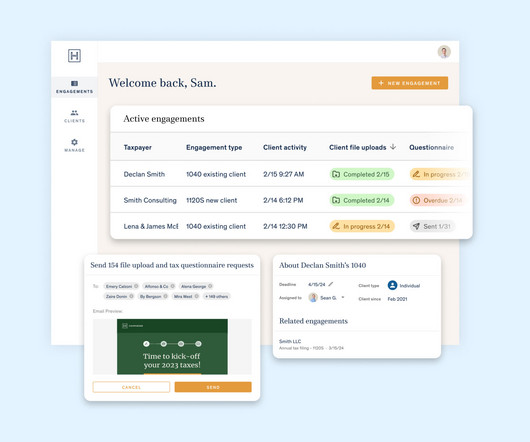

Offering Tax Preparation As A Solo Advisor: How To Attain Designations And Create A Schedule By Next Tax Season

Nerd's Eye View

MAY 8, 2023

Traditionally, financial advice and tax preparation have existed as 2 related, but separate, services. CPA, EA, or JD) to prepare tax returns and represent clients before the IRS, there has also been the impression that there is simply not enough time for one person to do both.

Let's personalize your content