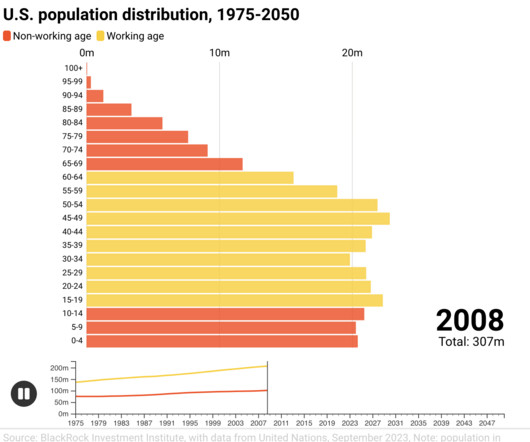

U.S. population distribution, 1975-2050

The Big Picture

MARCH 15, 2024

We sometimes say “Demographics is Destiny,” but that’s abstract. To get a visual sense of what that looks like, see the above chart (via Blackrock ) showing the distribution of various age groups from 2075 to 2050. Note bars in Red are not in the workforce. The post U.S. population distribution, 1975-2050 appeared first on The Big Picture.

Let's personalize your content