Sunday links: addressing existential challenges

Abnormal Returns

SEPTEMBER 3, 2023

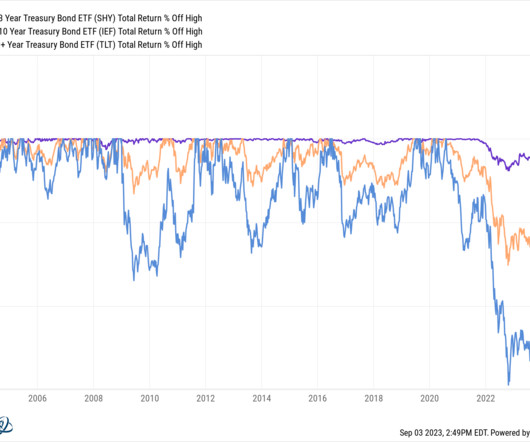

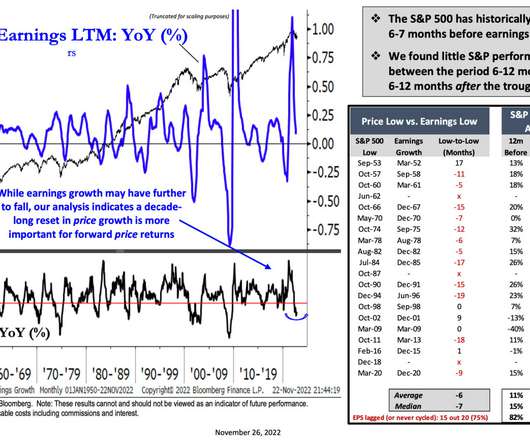

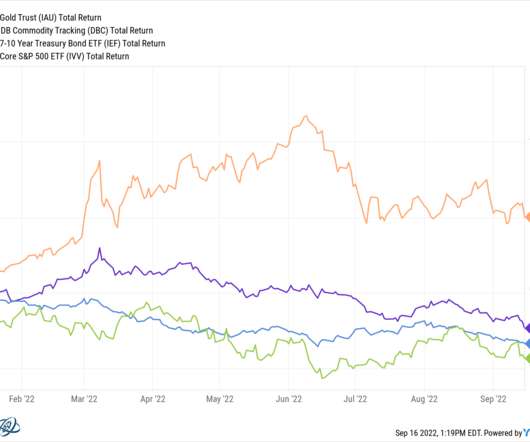

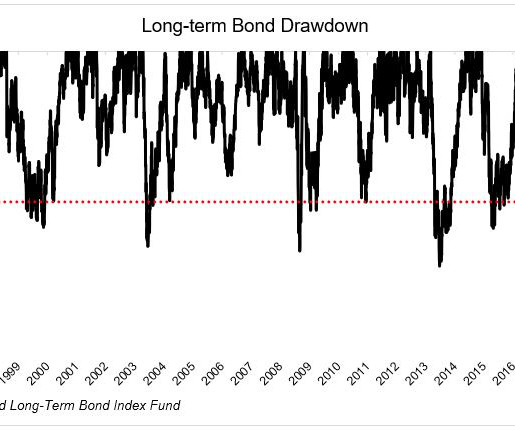

Strategy The math on the 60/40 portfolio looks a lot different than it did a year ago. washingtonpost.com) Economy The U.S. awealthofcommonsense.com) There is a difference between picking and choosing. humbledollar.com) Companies Nvidia ($NVDA) has succeeded with a distributed workforce. labor market is slowing.

Let's personalize your content