Paid Solicitation Under The SEC Marketing Rule: Using Third-Parties For Lead Generation And Prospecting

Nerd's Eye View

FEBRUARY 1, 2023

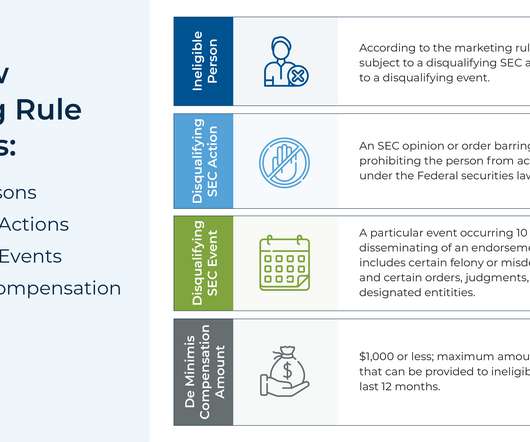

Financial advisors who pay third parties to solicit or refer prospective clients to generate new business have historically been subject to the SEC’s Cash Solicitation Rule. Additionally, investment advisers should ensure they disclose the promoter relationship in their Form ADV Part 1 and Form ADV Part 2A.

Let's personalize your content