You can’t handle the truth – Do the Math on the 2023 Bull Market

David Nelson

JUNE 20, 2023

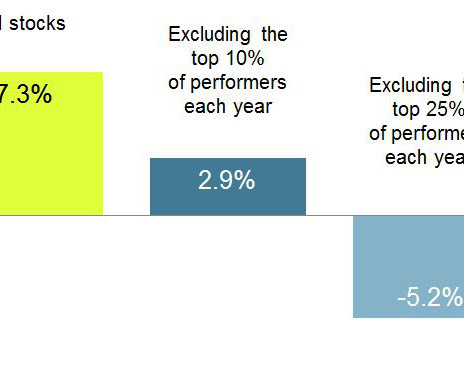

Even with that as a continued threat, evidence continues to mount that an ever-rising number of companies are starting to participate in the most hated bull market of my career. Do the Math Let’s do the math. At the time of this article some funds managed by David were long AAPL, MSFT, GOOGL, AMZN & NVDA

Let's personalize your content