Kitces & Carl Ep 121: Can You Just Do Good Work And Get Noticed As An Advisor Or Do You Have To Self-Promote?

Nerd's Eye View

SEPTEMBER 21, 2023

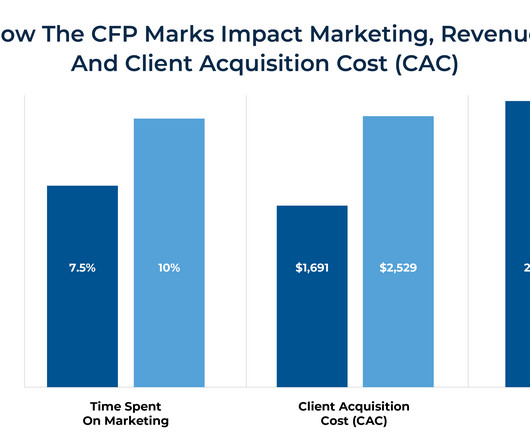

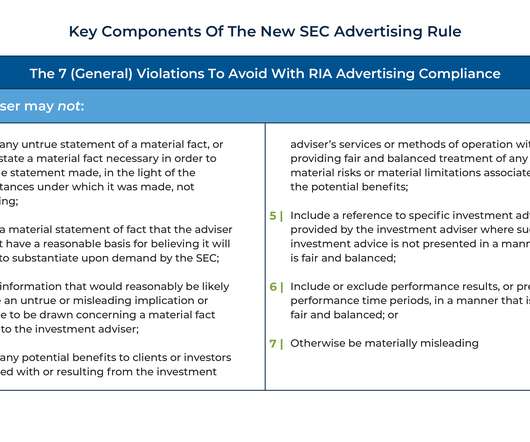

Regardless of the size of a financial advisory firm, clients are a constant necessity to sustain a profitable business. Ultimately, advisors who can provide exceptional service to their clients don't necessarily need to promote themselves through commonly used avenues of advertising (e.g., Read More.

Let's personalize your content