2 Ways the 2022 Economic Woes Affected Your Retirement Accounts

Integrity Financial Planning

JANUARY 9, 2023

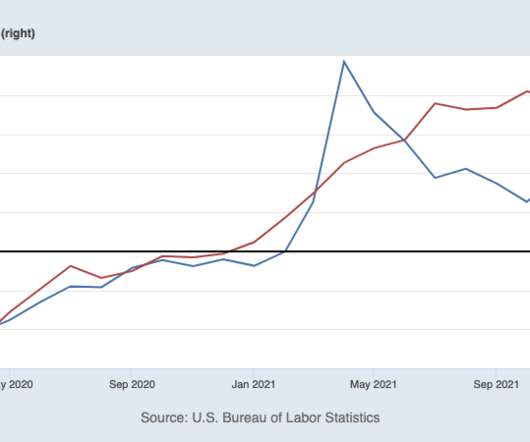

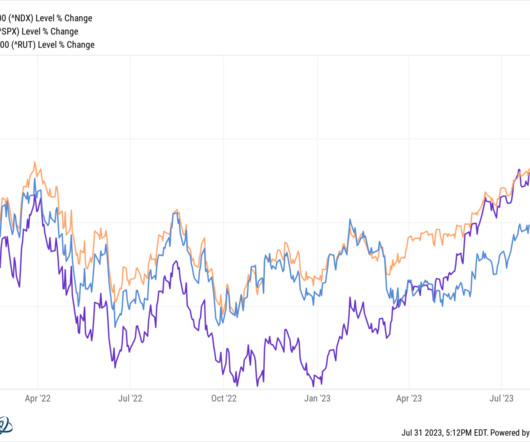

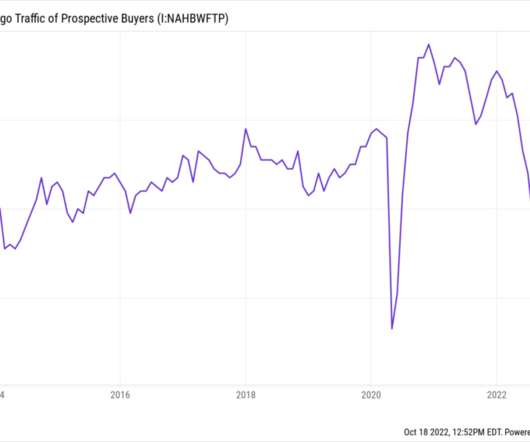

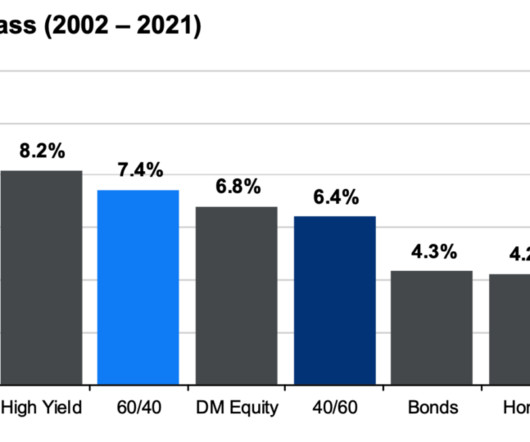

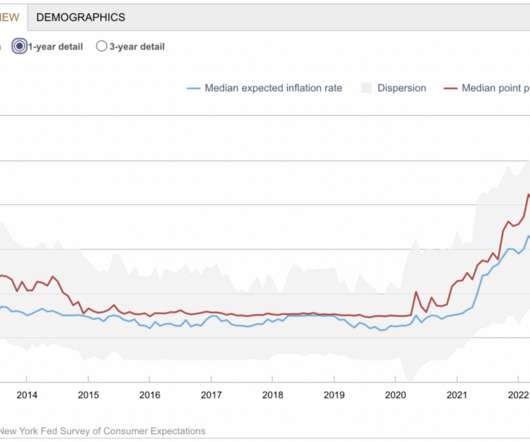

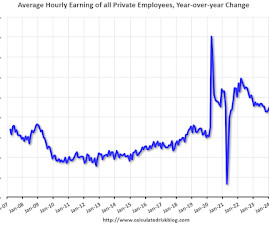

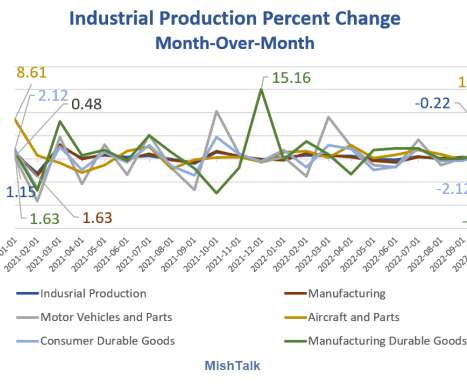

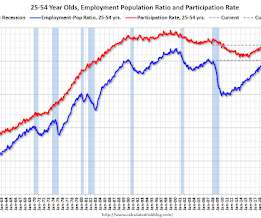

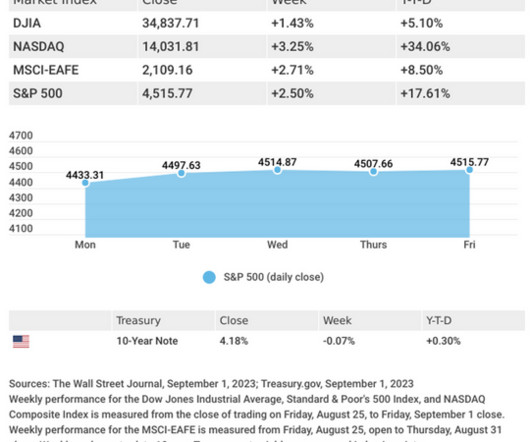

The 2022 economic climate has been bumpy for most and, in some cases, even bumpier for retirees. Americans and the world at large dealt with the economic ramifications of the Russia-Ukraine war, post-pandemic industrial effects, and rising inflation and interest rates. 1] However, in 2022, this number spiked to 9.1% 1] [link].

Let's personalize your content