Tuesday links: a healthy accounting system

Abnormal Returns

NOVEMBER 1, 2022

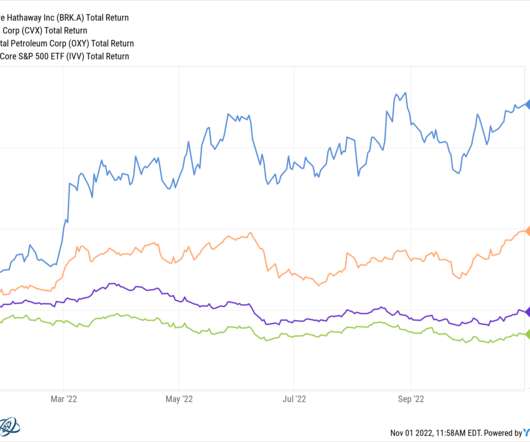

Markets How major asset classes performed in October 2020. capitalspectator.com) Don't be surprised to see the stock market rally before the economy bottoms out. every.to) Q3 saw big drops in startup valuations. abnormalreturns.com) Why rough edges remain in financial markets: people.

Let's personalize your content