Tuesday links: a healthy accounting system

Abnormal Returns

NOVEMBER 1, 2022

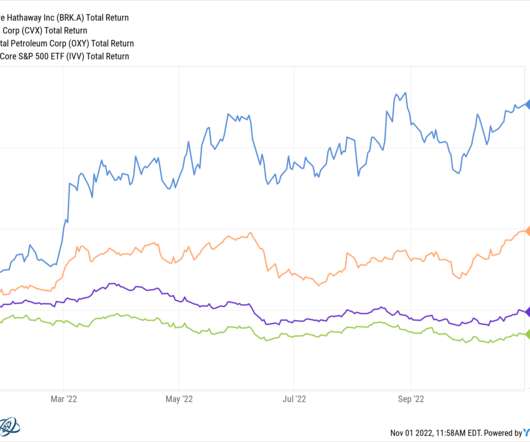

Markets How major asset classes performed in October 2020. capitalspectator.com) Don't be surprised to see the stock market rally before the economy bottoms out. finance.yahoo.com) Strategy Joe Wiggins, "There is a stigma attached to saying “I don’t know”, not just in the investment industry but in many walks of life."

Let's personalize your content