Seattle Redux: Misunderstanding Seasonal Adjustments

The Big Picture

JUNE 9, 2024

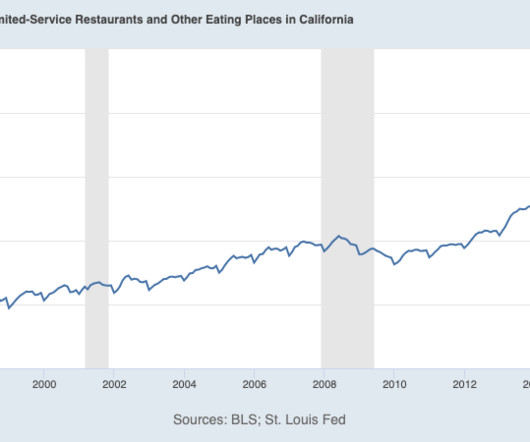

@TBPInvictus here. About a decade or so ago, the city of Seattle undertook to raise its minimum wage, over time, to $15/hour. (Massive credit to my friend Nick Hanauer for his efforts to make that happen.) What followed in the immediate aftermath of both the announcement and implementation was nothing less than a apocalyptic, collective head explosion on the right about the devastating effects the increase would have, particularly in the food services sector: However, there’s little doubt that t

Let's personalize your content