Top clicks this week on Abnormal Returns

Abnormal Returns

OCTOBER 29, 2023

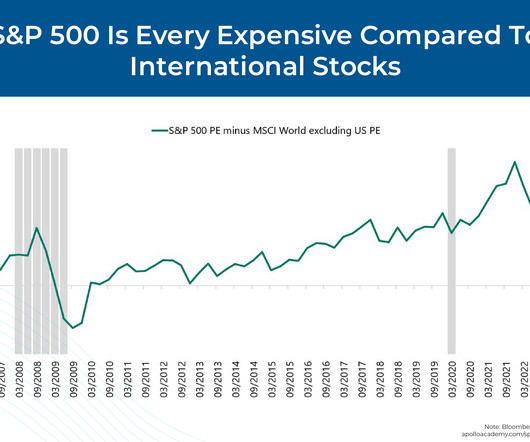

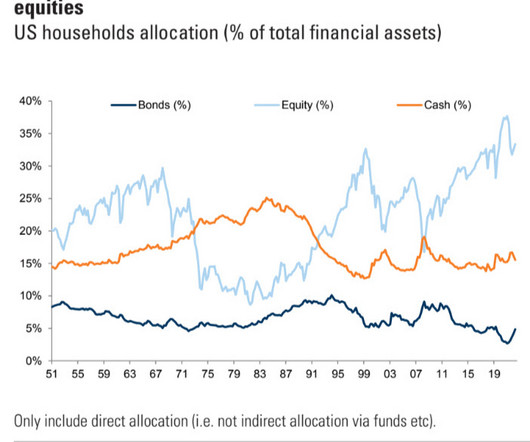

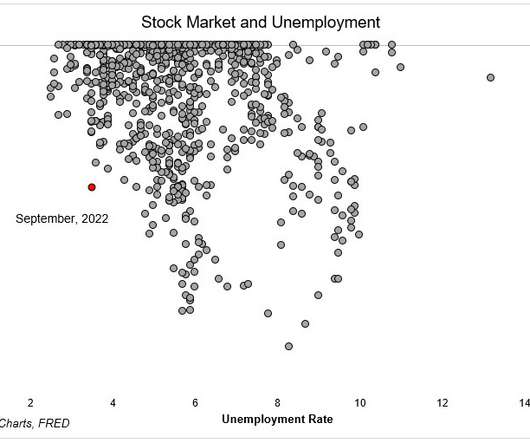

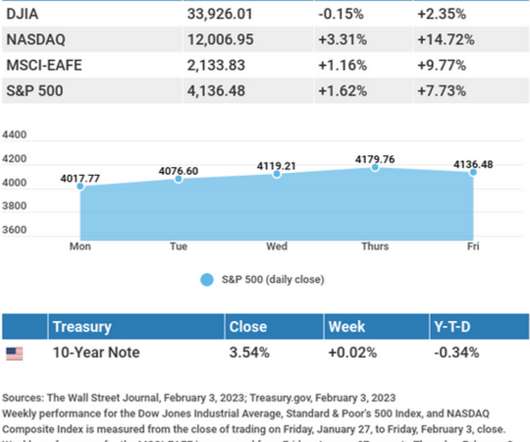

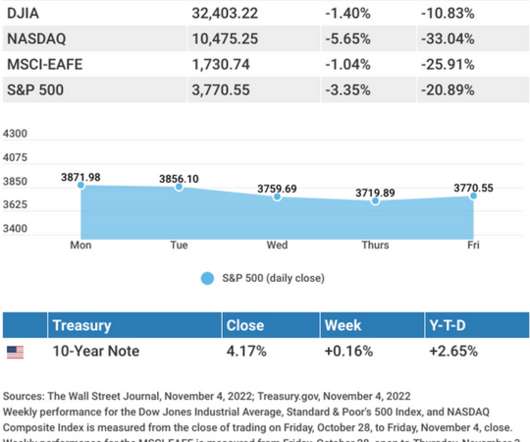

Top clicks this week A big regime shift has happened in the economy and financial markets. ritholtz.com) The bond market bear market is pretty epic. wired.com) Bond bear markets are different than stock bear markets. awealthofcommonsense.com) Where the valuation of the 60/40 portfolio stands.

Let's personalize your content