The Economy vs. Interest Rates

Bell Investment Advisors

NOVEMBER 6, 2023

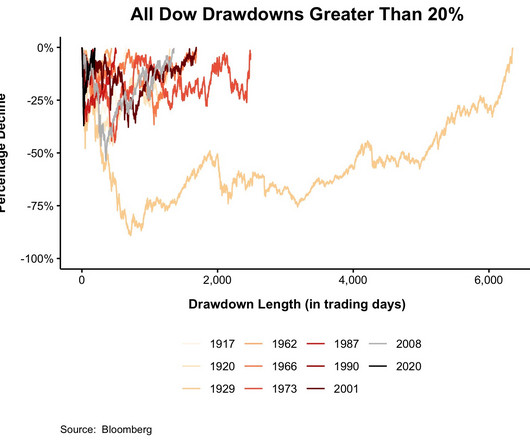

The economic backdrop to these losses, however, stands out. labor market. The broader economy surprises, too. A report from the Bureau of Economic Analysis showed that gross domestic product grew at an inflation-adjusted annual rate of 4.9% stocks and U.S. bonds declined in October, falling by 2.3% and 1.3%, respectively.

Let's personalize your content