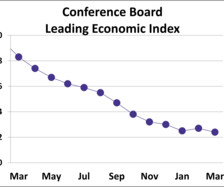

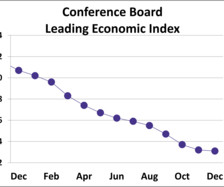

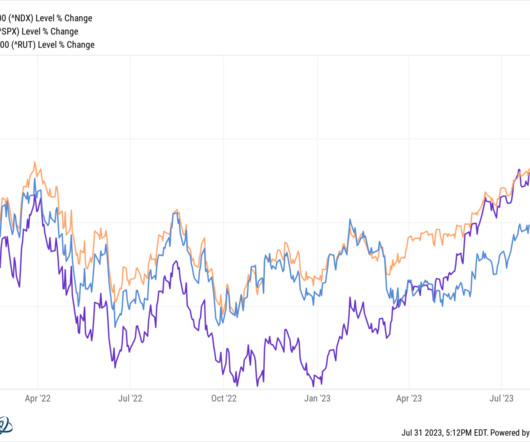

CB Leading Economic Index: Fragile Outlook for U.S. Economy

Advisor Perspectives

APRIL 19, 2024

The Conference Board Leading Economic Index (LEI) decreased in March to its lowest level since May 2020. The index fell 0.3% from last month to 102.4. Overall, the LEI continues to signal a fragile outlook for the U.S.

Let's personalize your content