Danny Kahneman: What if Everything is Narrative Fallacy?

The Big Picture

MARCH 28, 2024

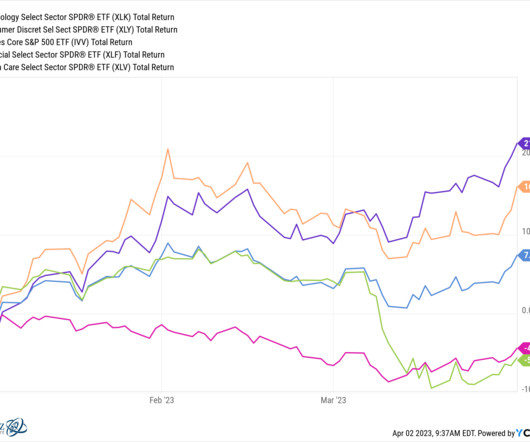

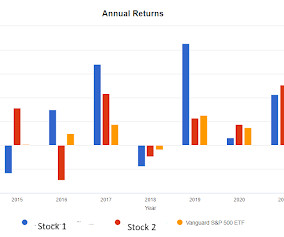

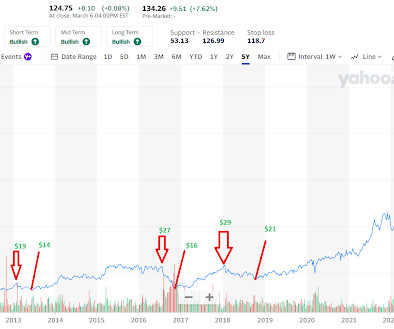

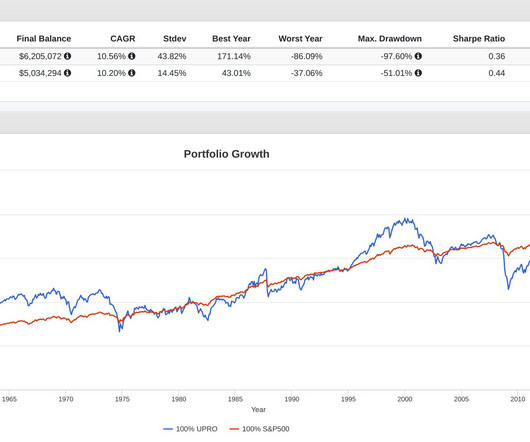

If you believed these stories, and acted on them, your portfolio probably did poorly in markets over this era. What’s so fascinating about each of these eras is how a very coherent narrative storyline came together to explain things that are perhaps more random and unexplainable than we are comfortable with.

Let's personalize your content