The Advisory | June 2015

Brown Advisory

JUNE 3, 2015

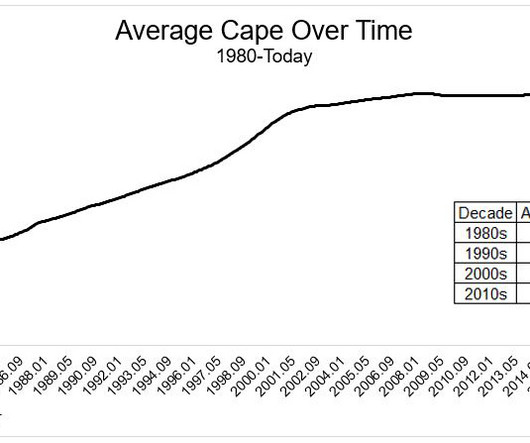

The Advisory | June 2015. Wed, 06/03/2015 - 10:14. Ahead of the first tightening by the Federal Reserve in nine years, we are shifting into less-traditional assets, anticipating that, at best, U.S. Concern about future economic growth undermines valuations. This argues for shifting assets away from U.S.

Let's personalize your content