Round Trip

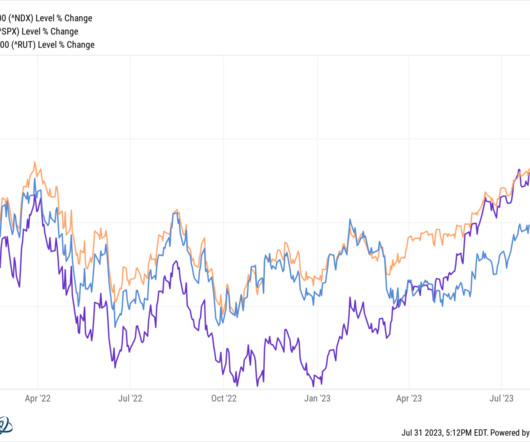

The Big Picture

AUGUST 1, 2023

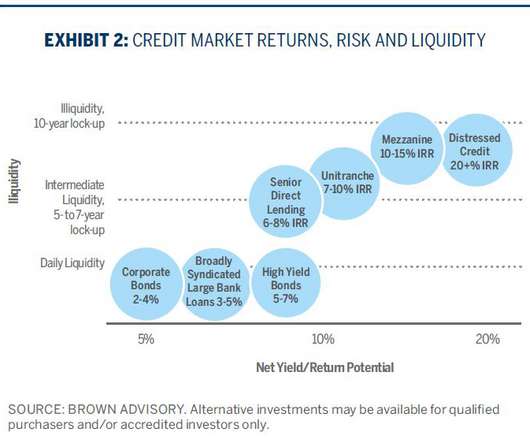

are fast-growing, highly profitable key players in the modern economy. But we won’t know how big a losing trade it might be until early 2024, when we see the updated valuations. Investors hold asset classes, to benefit from long-term value creation and compounding. They were piling into private credit.

Let's personalize your content