The Advisory | June 2015

Brown Advisory

JUNE 3, 2015

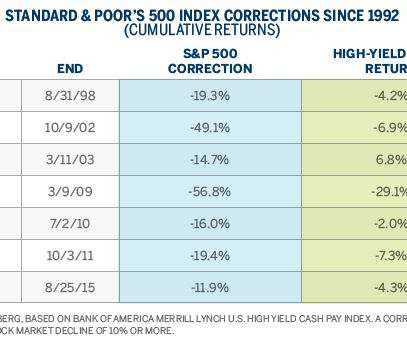

The Advisory | June 2015. Wed, 06/03/2015 - 10:14. Ahead of the first tightening by the Federal Reserve in nine years, we are shifting into less-traditional assets, anticipating that, at best, U.S. In many clients’ portfolios we have eliminated our overweight position in U.S. This argues for shifting assets away from U.S.

Let's personalize your content