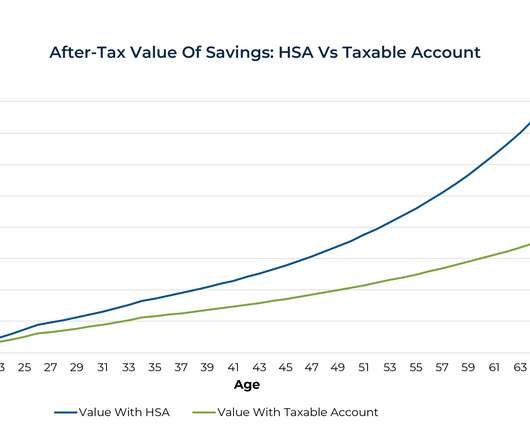

Maximizing Health Savings Accounts (HSAs) Tax Benefits With Adult Children Under Age 26

Nerd's Eye View

NOVEMBER 9, 2022

The passage of the Affordable Care Act in 2014 introduced many changes to the healthcare landscape in the United States. And as HSAs offer significant tax advantages, advisors can help clients ensure that opting for family HDHP makes sense financially for the family as a whole! Read More.

Let's personalize your content