Weekend Reading – Is Inflation Dead?

Discipline Funds

NOVEMBER 17, 2023

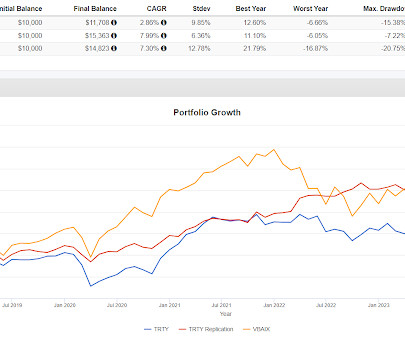

according to Siegel (2014). A lot of this depends on which market you look at and what time horizon, but the global stock market has generated nowhere near 10% when you account for real factors like inflation, taxes and fees. We live in the real world where we pay for inflation, taxes and fees over time.

Let's personalize your content