Adviser links: making the right decisions

Abnormal Returns

APRIL 15, 2024

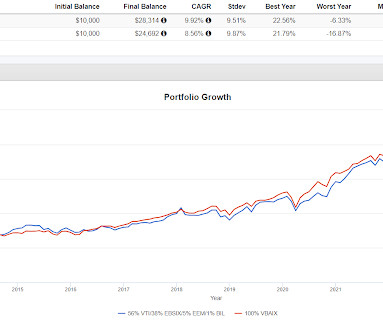

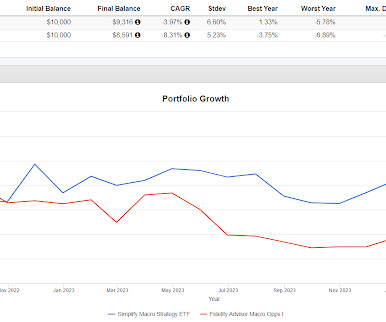

standarddeviationspod.com) Christine Benz and Amy Arnott talk asset allocation and more with Matt Krantz. riabiz.com) Retirement accounts On the downside of holding non-traditional assets in an IRA. investmentnews.com) Why funds in pre-tax retirement accounts need to be adjusted for taxes.

Let's personalize your content