Labor or Capital Driven Inflation?

The Big Picture

NOVEMBER 7, 2022

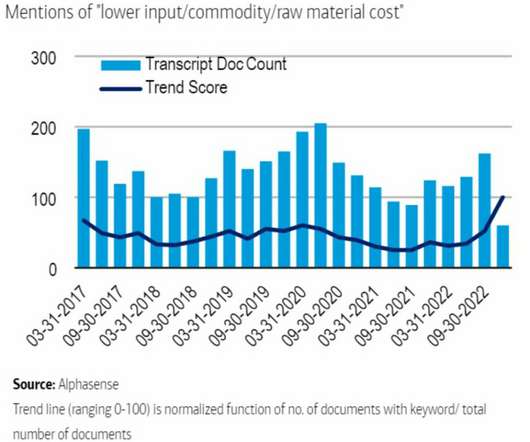

When I put together my list of what was to blame for inflation , corporate profit-seeking was number (13 of 15). price growth that characterized the pre-pandemic business cycle of 2007–2019. Generally speaking, high-profit margins are not a sign of an economy that is overheating. That was June; we now have a lot more data.

Let's personalize your content