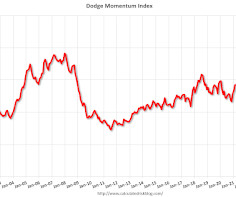

Leading Index for Commercial Real Estate Increases in October

Calculated Risk

NOVEMBER 8, 2022

The institutional component was varied, experiencing growth in recreational and education projects, countered by a decline in the number of healthcare and public planning projects. This graph shows the Dodge Momentum Index since 2002. Commercial planning was bolstered by a solid increase in office and hotel projects. in September.

Let's personalize your content