Anand Rathi Wealth Limited – Is It Riding the Wave of Growth?

Trade Brains

JANUARY 24, 2024

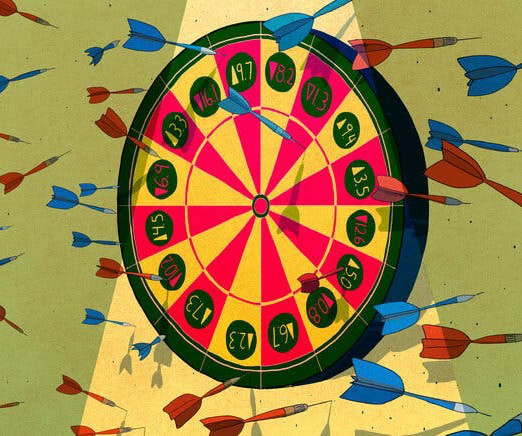

The Q3FY24 results displayed a positive outlook for the company with a 34% YoY increase in Total Revenue and 43% YoY in their assets under management (AUM). As of 2023, the industry boasts a staggering AUM (assets under management) of over Rs 39.4 The number of taxpayers having an income of > Rs. in FY18 to 15.2%

Let's personalize your content