10 Monday AM Reads

The Big Picture

SEPTEMBER 26, 2022

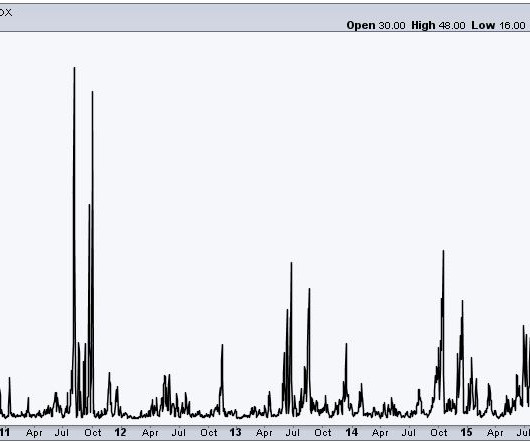

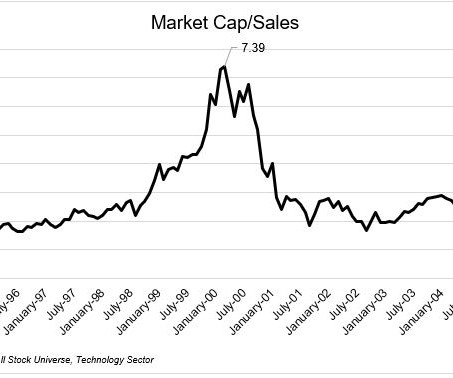

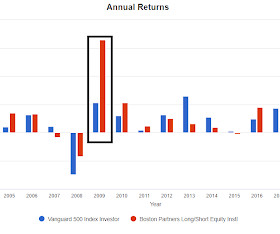

The only other years with a higher reading since 1990 were 2008 when the S&P fell 38%, and 2002, when it fell 23%. Why Jack Welch Wouldn’t Cut It Today : Bill George, a legendary CEO in his own right, says good quarterly numbers aren’t necessarily indicative of strong leadership. Investors Keep Piling In Anyway.

Let's personalize your content