Tuesday links: ironclad proof

Abnormal Returns

APRIL 9, 2024

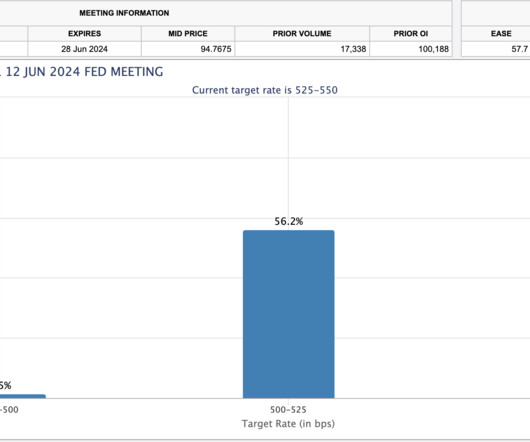

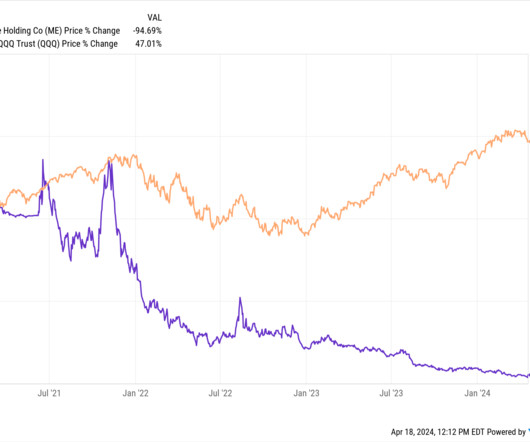

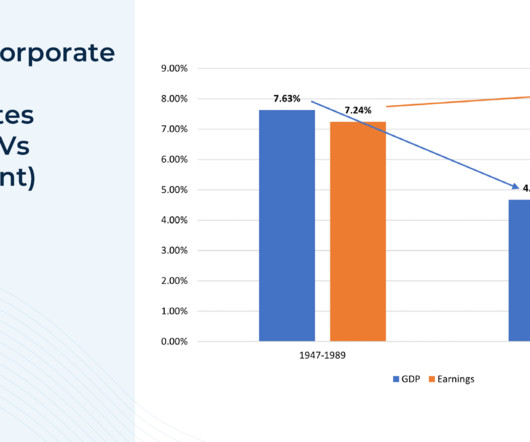

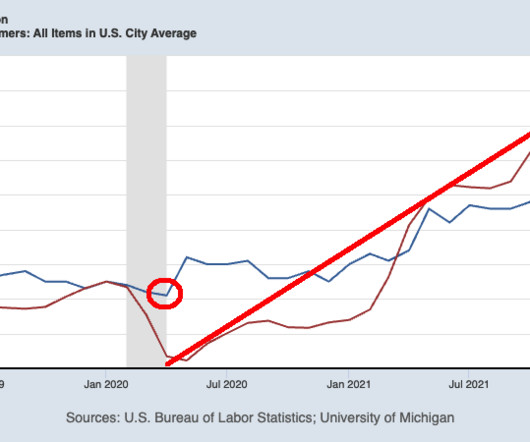

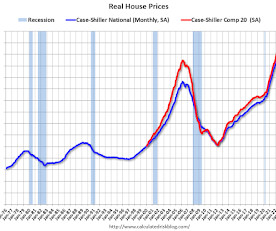

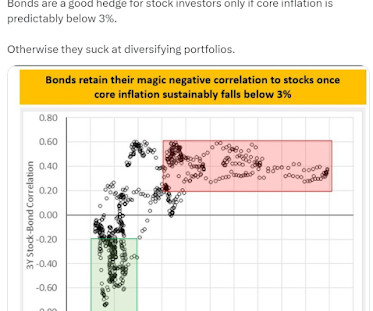

Markets Investors are coming to terms with higher short-term interest rates. barrons.com) The rise in Bitcoin has caused some long term holders to sell. construction-physics.com) Good luck trying to repurpose a movie theater for other uses. wsj.com) Minor league baseball teams are running into real estate problems.

Let's personalize your content