Friday links: the most important investing skill

Abnormal Returns

JANUARY 20, 2023

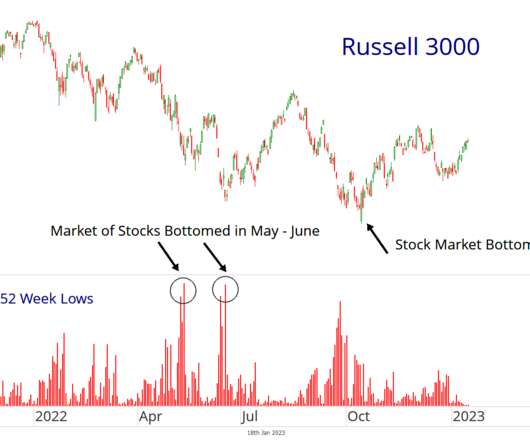

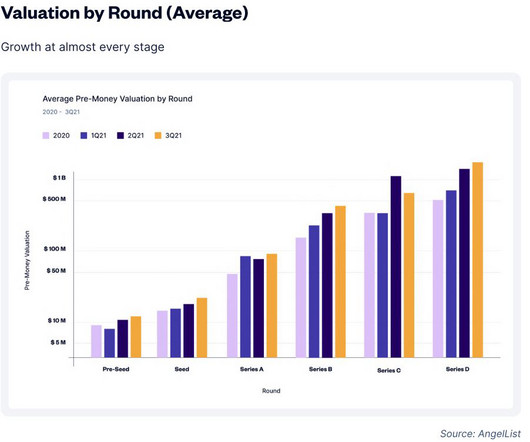

wsj.com) Don't let your portfolio be driven by strategist forecasts. ft.com) Startups How unicorns are dealing with the decline in valuations. news.crunchbase.com) Crypto companies, like FTX, invested in a bunch of crypto startups. Markets What a 'breakaway momentum thrust' means for investors.

Let's personalize your content