At the Money: How to Pay Less Capital Gains Taxes

The Big Picture

JANUARY 24, 2024

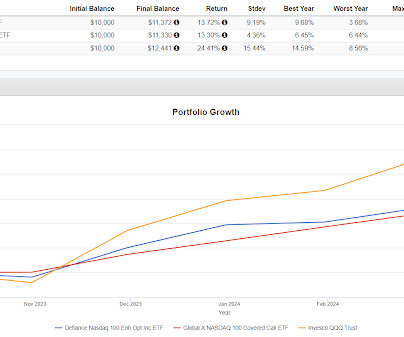

At the Money: How to Pay Less Capital Gains Taxes (January 24, 2024) We’re coming up on tax season, after a banner year for stocks. How can you avoid sticker shock when Uncle Sam comes knocking? On this episode of At the Money, we look at direct indexing as a way to manage capital gains taxes. Equity returns.

Let's personalize your content