Market Commentary: Carson Investment Research Looks at the Year Ahead

Carson Wealth

JANUARY 16, 2024

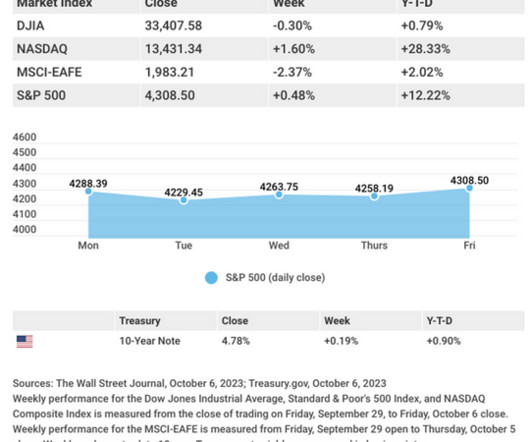

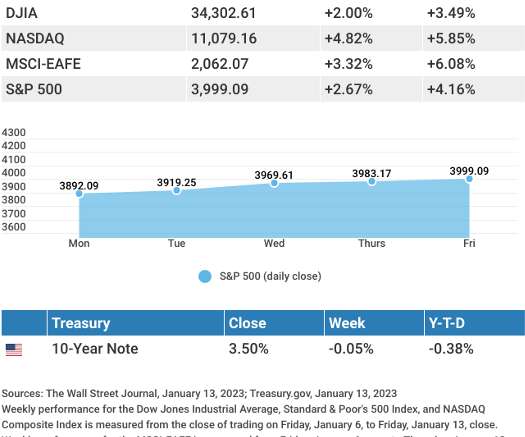

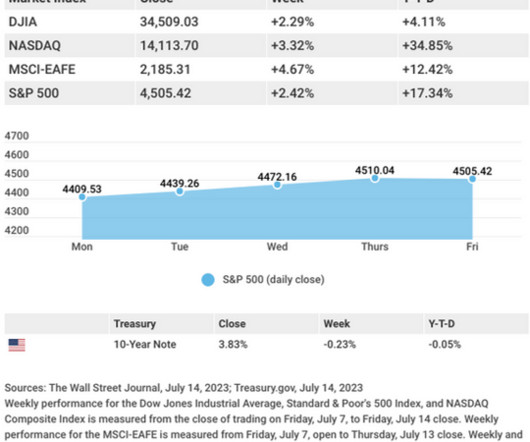

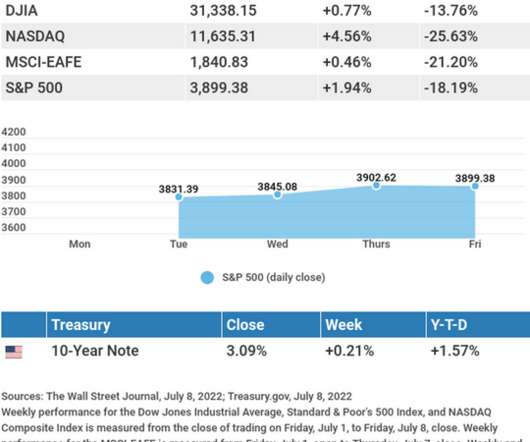

Carson Investment Research 2024 Market Outlook: Seeing Eye to Eye We are targeting a total return of 11-13% for the S&P 500 Index in 2024 and 4-6% for the Bloomberg U.S. We take a deep dive into our outlook for 2024 in Carson Investment Research’s Outlook ‘24: Seeing Eye to Eye. In addition, the investment in the U.S.

Let's personalize your content