Asness on Value Investing & Humility

The Big Picture

FEBRUARY 24, 2023

They discuss AQR’s 60/40 portfolio strategy and the risks facing financial markets, with Sonali Basak and Guy Johnson on “Bloomberg Markets.”

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

The Big Picture

FEBRUARY 24, 2023

They discuss AQR’s 60/40 portfolio strategy and the risks facing financial markets, with Sonali Basak and Guy Johnson on “Bloomberg Markets.”

Trade Brains

DECEMBER 2, 2023

Top Value Investing Courses in 2024 : From a long-term perspective, investing has been a successful way for people to build wealth. Value investing is a challenging and exciting field that requires the right information and direction to successfully navigate. With over +3241 enrollments and a +4.4

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

OCTOBER 29, 2023

Top clicks this week A big regime shift has happened in the economy and financial markets. ritholtz.com) The bond market bear market is pretty epic. mrzepczynski.blogspot.com) Byron Wien's 20 rules for investing and life. wired.com) Bond bear markets are different than stock bear markets.

WiserAdvisor

FEBRUARY 14, 2024

You can also consider unique investment ideas that align with your interests and goals. A financial advisor can help you identify hobbies that can be turned into wealth-creating avenues. They can also help you include some uncommon types of investments that can contribute to your overall financial growth.

Truemind Capital

JANUARY 16, 2024

Equity Market Insights: “Investing is 5% intellect and 95% temperament. It means finding the strategy that will allow you to sit quietly when your emotions are screaming at you to do the wrong thing.” – Ian Cassel Unfortunately, having the right temperament for investment is not common.

Truemind Capital

AUGUST 12, 2023

India being highlighted as a beneficiary from the shift in Global equations along with the expected highest economic growth among major economies has attracted strong flows from the FIIs lifting overall market sentiments. The recent rally in the market has made the valuations more expensive compared to historical standards.

Abnormal Returns

OCTOBER 31, 2022

(allstarcharts.com) And valuations are still attractive. awealthofcommonsense.com) Joachim Klement, "The people who are committed to sin stock investing are a small minority and are unlikely to shift the consensus away from the ESG investing trend." abnormalreturns.com) Why rough edges remain in financial markets: people.

Brown Advisory

AUGUST 14, 2023

Global Leaders Strategy Investment Letter: August 2023 bgregorio Mon, 08/14/2023 - 05:34 Just want the PDF? Factor risk is best described as any exposure that can explain the portfolio returns other than the individual investments, such as a “theme” or a sector. For us, the factors are basically a wash over a long horizon.

Abnormal Returns

NOVEMBER 6, 2022

abnormalreturns.com) Why rough edges remain in financial markets: people. aswathdamodaran.blogspot.com) Small cap valuations look attractive. humbledollar.com) Jason Zweig, "Self-control is a key to investing success, but so is fending off self-delusion." Also on the site Spending does more than change your bank balance.

Abnormal Returns

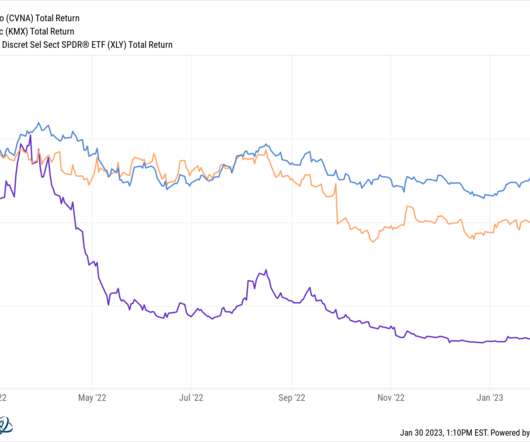

JANUARY 30, 2023

awealthofcommonsense.com) Rubin Miller, "The stock market is brashly indifferent to our opinions." fortunesandfrictions.com) Why you need a well-articulated investment strategy to ride out tough times. nytimes.com) Funds How the launch of the SPDR S&P 500 ETF Trust ($SPY) changed financial markets.

Truemind Capital

APRIL 21, 2023

Higher valuation of Indian markets compared to Global peers along with negligible earnings growth also didn’t help. to take advantage of historically low valuations, expected continued growing global dominance in the long term, and for diversification purposes. 5%) and by RBI (25 bps to 6.5%). For the last 1.5 For the last 1.5

Nerd's Eye View

APRIL 3, 2024

Notably, the work-from-home movement has resulted in a dramatic drop in office valuations that could lead to a whole host of issues, including lending constraints in the banking sector, which is already sitting on a mountain of unrealized losses on Treasuries and mortgages.

The Big Picture

APRIL 5, 2023

Institutional Investor ) see also How Will AI Change Investing? We are less focused on the risks to REITs and more focused on where private market property valuations are going,” says Cohen & Steers’ Rich Hill. The Atlantic ) • How You Can Grab a 0% Tax Rate : The zero rate on investment income is often overlooked.

Investing Caffeine

JANUARY 3, 2022

But with that said, despite lacking the skill of 100% clairvoyance, my investment firm Sidoxia Capital Management and our strategies have performed quite well over the long-run for numerous reasons. As it turns out, the power of compounding, coupled with low-cost, tax-efficient investing can produce quite spectacular results.

Brown Advisory

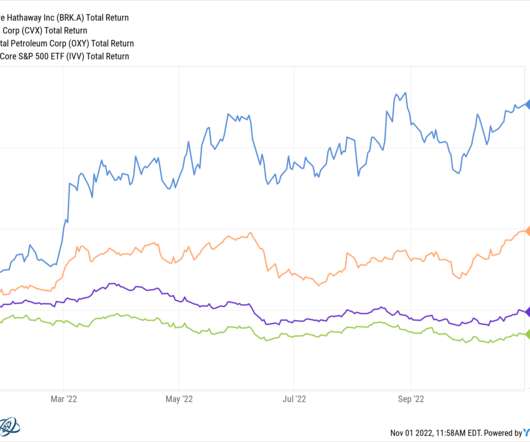

OCTOBER 31, 2022

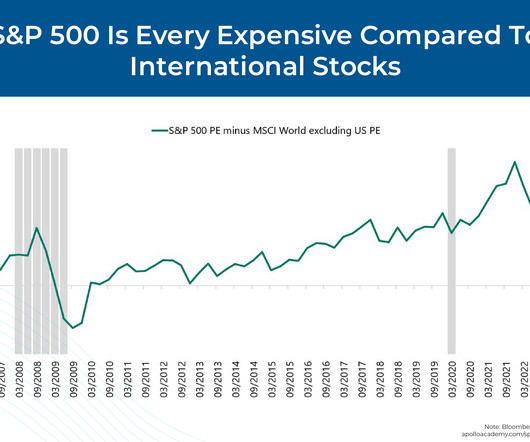

Escalating Uncertainty is Laying Bare the Dangers of Passive Equity Investing mhannan Mon, 10/31/2022 - 12:48 With history's longest bull market now in the rearview, passive investors are left highly exposed to an over-concentrated stock market that is on a collision course with a highly complex backdrop.

The Irrelevant Investor

MARCH 26, 2019

My first experience with "investing" - and I use quotes because what I was actually doing is an insult to real investors- was picking stocks based on a ratio I found on the internet. The first thing young investors find when they Google "best investing books" is Benjamin Graham's The Intelligent Investor.

The Big Picture

FEBRUARY 7, 2024

At the Money: Stock Picking vs. Value Investing with Jeremy Schwartz, Wisdom Tree. Should value investing be part of that strategy? TRANSCRIPT: Jeremy Schwartz Value Investing Barry Ritholtz : How much you pay for your stocks has a giant impact on how well they perform. What Is value investing?

Brown Advisory

NOVEMBER 12, 2019

Investment Perspectives | Confidence ajackson Tue, 11/12/2019 - 16:31 Despite making new highs recently, U.S. Among the concerns breeding skepticism about the economy and the markets are on-again/off-again trade negotiations, disruption of supply chains, declines in manufacturing activity, and sluggish capital spending.

Brown Advisory

NOVEMBER 12, 2019

Investment Perspectives | Confidence. Among the concerns breeding skepticism about the economy and the markets are on-again/off-again trade negotiations, disruption of supply chains, declines in manufacturing activity, and sluggish capital spending. financial markets, to be a global leader for more than a century.

Brown Advisory

SEPTEMBER 11, 2016

September 2016 Insights on Markets and Investments achen Mon, 09/12/2016 - 01:00 In this issue: Investors Facing Rising Risks Need Solid Defense, Savvy Offense Increasing political and economic risk during the past year has widened the range of possible positive and negative scenarios for financial markets.

Brown Advisory

SEPTEMBER 11, 2016

September 2016 Insights on Markets and Investments. In this issue: Investors Facing Rising Risks Need Solid Defense, Savvy Offense Increasing political and economic risk during the past year has widened the range of possible positive and negative scenarios for financial markets. Mon, 09/12/2016 - 01:00.

Abnormal Returns

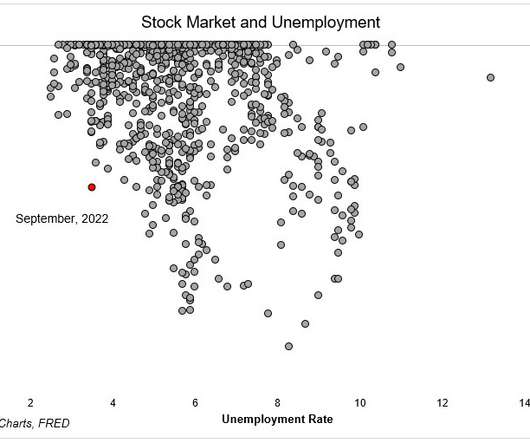

NOVEMBER 1, 2022

(capitalspectator.com) Don't be surprised to see the stock market rally before the economy bottoms out. finance.yahoo.com) Strategy Joe Wiggins, "There is a stigma attached to saying “I don’t know”, not just in the investment industry but in many walks of life." every.to) Q3 saw big drops in startup valuations.

Brown Advisory

SEPTEMBER 12, 2016

Private Credit Outshines Many High-Valuation Stocks, Bonds. With interest rates at record lows and many publicly traded bonds and stocks approaching historically high valuations, private credit has become increasingly attractive to investors because of its total return prospects, steady income and role in diversification.

Brown Advisory

JANUARY 4, 2016

Investment Perspectives | Unicorns: Beyond the Myth. What is behind this sudden surge in the unicorn population, and are some of these valuations “spiraling” out of control? Small-cap growth stocks, particularly in technology and biotech, have been among the market leaders during the post-crisis recovery. Lee coined the term.

Trade Brains

FEBRUARY 20, 2024

Recognized by the Reserve Bank of India, it operates as a non-deposit-taking NBFC, focusing on investments and loan provisions. The company has only one line of business, i.e., financing and investment activities and has no activity outside India. The company had 1.99% of net NPAs as a percentage of net advances as of March 31, 2023.

Alpha Architect

MARCH 10, 2023

Short sellers help keep market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. Market efficiency is important because an efficient market allocates capital efficiently. <strong>Are Short Covering Trades Informative?

Brown Advisory

JULY 1, 2015

Investment Perspectives | Sound and Fury. At times, it seems like this is the only issue on the minds of market prognosticators and TV’s talking heads. As shown in the chart on page 2, even the slightest hint of a possible move from the Fed can trigger a financial market reaction. Wed, 07/01/2015 - 16:45. That makes U.S.

Trade Brains

FEBRUARY 16, 2024

The company recently made waves in the financial markets with its IPO with an astonishingly high Price-to-Earnings (PE) ratio of 292x! As we delve into the intricate details of Azad Engineering Limited, we’ll investigate whether this seemingly high valuation aligns with the company’s underlying business prospects.

Investing Caffeine

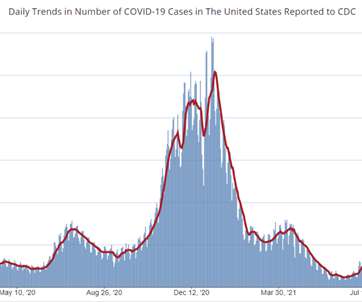

NOVEMBER 1, 2021

Fortunately, for those invested in stocks, they experienced the opposite this last month – a flood of green (new all-time record highs), despite a whole host of frightening factors, including the following: · Inflation. Valuations (How cheap or expensive is the market?). . Supply chain disruptions. COVID variants.

Discipline Funds

DECEMBER 9, 2023

So a more efficient market based portfolio (a truly passive indexing approach) actually requires a more dynamic rebalancing approach. More interesting here is that John Bogle personally used a Countercyclical rebalancing methodology using valuations. He wasn’t doing this to “beat the market”. 3) Commodities Can’t Catch a Bid.

Investing Caffeine

APRIL 1, 2022

At Sidoxia , we are determined to objectively stick to the facts and migrate investments to the areas of the market that provide the best risk-reward opportunities to our clients, based on their unique objectives and constraints. They certainly could, but valuations remain attractive given where interest rates currently stand.

Trade Brains

AUGUST 18, 2023

India has multiple investors with crores of personal wealth invested in the stocks. Vijay Kedia primarily invests in small companies which have medium experience but are eying large market share in the future. He calls his investment philosophy ‘SMILE’. Who is Vijay Kedia? Or are even ace investors prone to mistakes?

Trade Brains

OCTOBER 12, 2023

Research & Development KPIT Technologies has been actively invested in R&D such as Hydrogen Generation from Biomass, Sodium-ion Battery, and Hydrogen Fuel Cell. > KPIT and ZF invested in a company named “QORIX” which will aid in the development of the Automotive middleware stack. Let us know your view on this.

Validea

OCTOBER 4, 2022

Though stocks and bonds continue to drop and the housing market has weakened, financial markets are moving toward normal, posits an article in Barron’s. Quick Links Validea Special Discount Offer Top Value Stocks in Today’s Market Screen for Stocks Using Peter Lynch’s GARP Method.

Cornerstone Financial Advisory

FEBRUARY 6, 2023

Another Rate Hike The Federal Reserve raised interest rates by 0.25%, signaling to the financial markets that it would likely hike rates by another 25 basis points at its next meeting in late March. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

Trade Brains

NOVEMBER 24, 2023

Financial Year D/E Interest Coverage 2022-23 0.03 Market Cap (Cr.) Dividend Yield (%) 0.30% Future Plans Of CE Info Systems The company has invested around Rs 7 crore to acquire a 20% stake in Indrones Solutions, engaged in drone manufacturing and data analytics, to increase its presence in the market. 2020-21 0 32.21

Investing Caffeine

FEBRUARY 1, 2022

This notion rings especially true when it comes to finance and investing. As I have discussed numerous times in the past, money goes where it is treated best, which is why interest rates, cash flows, and valuations play such a key role in ultimately determining long-term values across all asset classes. www.Sidoxia.com.

Trade Brains

AUGUST 31, 2023

However, because of their small size, it is inherently risky to invest in penny stocks. Furthermore, it has also invested in hydropower generation in recent years establishing itself as an integrated player. DU Digital Global is debt-free and currently has a micro-cap valuation of Rs 316 crore. 382 EPS (TTM) ₹1.2 FII Holding 13.2%

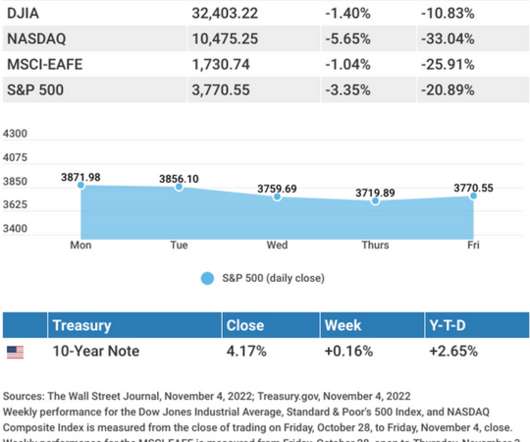

Cornerstone Financial Advisory

NOVEMBER 7, 2022

Presented by Cornerstone Financial Advisory, LLC. Hawkish comments by Fed Chair Jerome Powell, following the announcement of another 75 basis points interest rate hike last week, cast a pall over financial markets, sending yields higher and stocks lower. When sold, investments may be worth more or less than their original cost.

Good Financial Cents

DECEMBER 14, 2022

After all, people will always need financial services, whether investing their money , taking out loans, or managing their taxes. Most financial managers have previous experience working in market analysis and forecasting positions similar to this one. Investment Banker. Financial Analyst.

Investing Caffeine

FEBRUARY 1, 2023

Source: Clearnomics and Standard & Poor’s Presently, economic skies might not all be clear, blue, and sunny, but the fact that inflation is dropping, our economy is still growing, labor markets remain healthy, China has reopened for business, and Europe hasn’t cratered all leave room for optimism. www.Sidoxia.com Wade W.

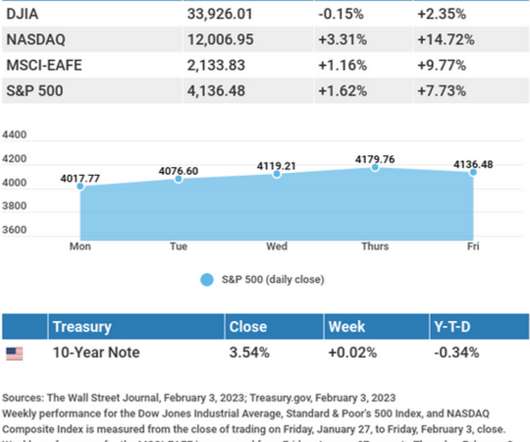

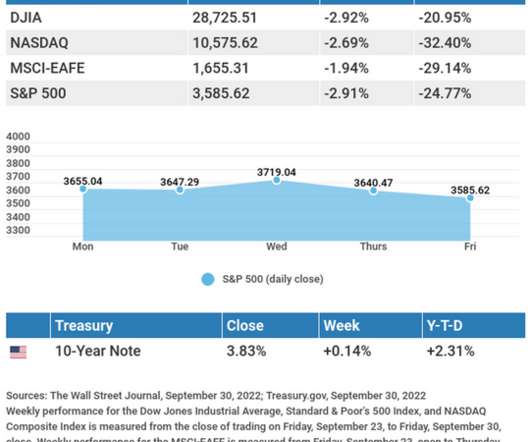

Cornerstone Financial Advisory

OCTOBER 3, 2022

Global bond and currency markets have been volatile recently due to global central bankers raising interest rates to combat inflation. Upending the financial markets was the previous week’s announcement of tax cuts by the country’s new prime minister, a step many investors viewed as counterproductive to the BOE’s inflation-fighting efforts.

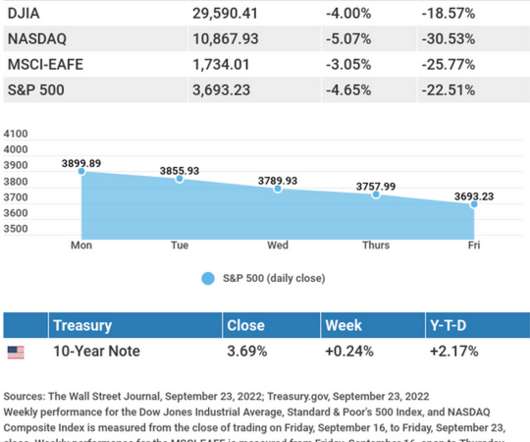

Cornerstone Financial Advisory

SEPTEMBER 26, 2022

The MSCI EAFE index, which tracks developed overseas stock markets, declined 3.05%. Last week’s meeting of the Federal Open Market Committee (FOMC) proved unsettling for the financial markets. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

Cornerstone Financial Advisory

OCTOBER 10, 2022

prime minister’s decision to reverse a tax cut proposal that had upended financial markets the previous week lifted investors. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. Individuals cannot directly invest in unmanaged indexes.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content