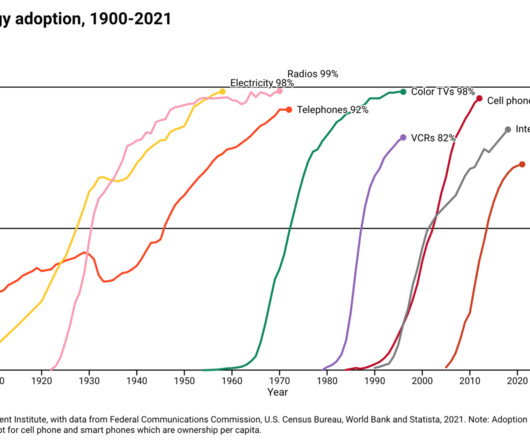

U.S. Technology Adoption, 1900-2021

The Big Picture

FEBRUARY 29, 2024

A century of tech adoption in 30 seconds click for animation Source: Blackrock The post U.S. Technology Adoption, 1900-2021 appeared first on The Big Picture.

The Big Picture

FEBRUARY 29, 2024

A century of tech adoption in 30 seconds click for animation Source: Blackrock The post U.S. Technology Adoption, 1900-2021 appeared first on The Big Picture.

Abnormal Returns

FEBRUARY 26, 2024

Podcasts Frazer Rice talks Florida and California property insurance issues with Aon's LaTanya Simmons. (open.spotify.com) Michael Kitces talks with Ben Hockema. who is the Founder of Illuminate Wealth Management about how to fund your RIA. (kitces.com) Daniel Crosby on why not caring what other people think is a valuable asset. (standarddeviationspod.com) Diana Britton talks with Michael Kitces about adviser well-being.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

FEBRUARY 28, 2024

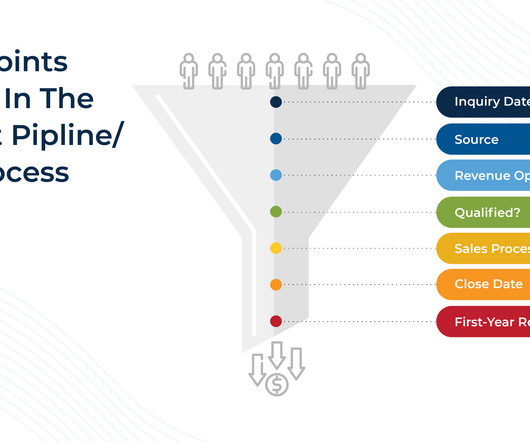

Initial outreach to a financial advicer rarely (if ever) results from a prospective client waking up in the middle of the night in a cold sweat because they just figured out that they're in desperate need of a comprehensive financial plan. Rather, prospects often reach out to set an initial appointment only when they realize they have a specific pain point that they need an advicer's help with.

Wealth Management

FEBRUARY 29, 2024

The firm’s board is already conducting a search for his successor. Additionally, Greg Davis has been appointed as president in addition to his current role as chief investment officer.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

The Big Picture

FEBRUARY 27, 2024

Transcript: The transcript from this week’s MiB: Andrew Slimmon, Morgan Stanley Investment Management , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ XXXXX ~~~ The post Transcript: Andrew Slimmon, Morgan Stanley Investment Management appeared first on The Big Picture.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

FEBRUARY 26, 2024

In the early days of the financial advice industry, an advisor's options for generating new business were somewhat limited. Cold calls, country club memberships, Chamber of Commerce networking, and referrals (from clients or centers of influence) were staples for growth, and determining how successful those sales-centric efforts were was rather straightforward.

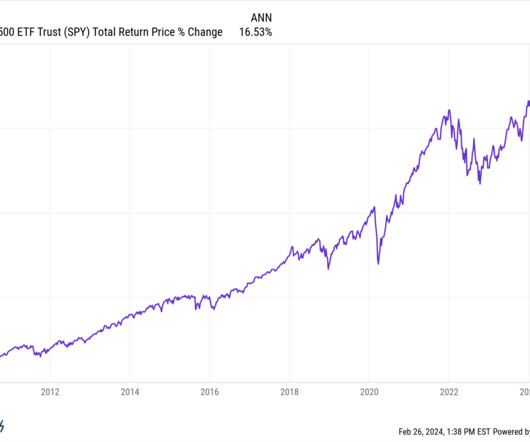

A Wealth of Common Sense

FEBRUARY 27, 2024

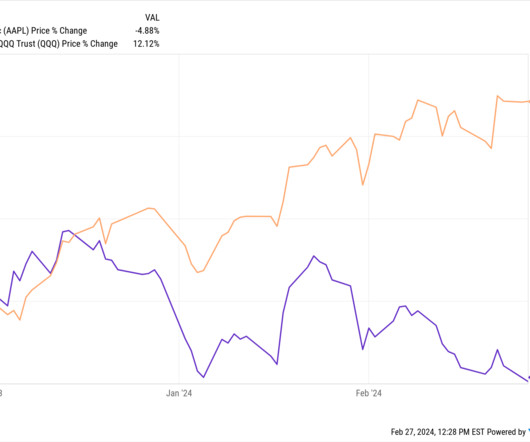

Despite 5% short-term interest rates and stickier inflation than some people would like and the Fed potentially pushing back interest rate cuts for a few months and the new True Detective seasons being a massive disappointment…the S&P 500 continues to take out new all-time highs. By my count there have already been a baker’s dozen in 2024 alone.1 Here are the new highs by year since 2015: 2015: 10 2016: 1.

Calculated Risk

FEBRUARY 29, 2024

From the NAR: Pending Home Sales Receded 4.9% in January Pending home sales in January dropped 4.9% , according to the National Association of REALTORS®. The Northeast and West posted monthly gains in transactions while the Midwest and South recorded losses. All four U.S. regions registered year-over-year decreases. The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 74.3 in January.

Abnormal Returns

FEBRUARY 27, 2024

Markets Communications and health care are leading the U.S. market in 2024. (capitalspectator.com) A closer look at Europe's answer to the Magnificent Seven stocks, GRANOLA. (biopharmadive.com) Strategy What happens when you invest right before a bear market? (awealthofcommonsense.com) The case for, but mostly against, dividend-focused ETFs. (ofdollarsanddata.com) Why it's so easy to get sucked into trading too much.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Irrelevant Investor

FEBRUARY 26, 2024

Today was one of the best days of my life. I got to meet and interview my favorite athlete of all time, Eli Manning. Surreal is putting it mildly. I’ve never felt more of an emotional connection to an athlete than Eli, and I never really thought about why until this weekend when I was writing an introduction for him. I am a lifelong die-hard Giants and Knicks fan.

A Wealth of Common Sense

MARCH 1, 2024

A podcast listener asks: How do you both manage to produce podcasts every week, handle your jobs, write, read, and raise families without burning out? How do you maintain this balance? What strategies do you use to recharge yourselves? Personally, when I go on vacation, I completely disconnect from work, yet I’ve noticed you guys continue podcasting even during your vacations.

Calculated Risk

FEBRUARY 28, 2024

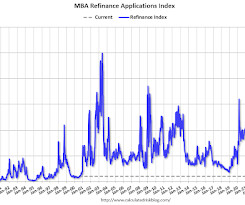

"Higher rates in recent weeks have stalled activity", Mike Fratantoni, MBA’s SVP and Chief Economist. From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 5.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 23, 2024.

Abnormal Returns

FEBRUARY 28, 2024

Markets Some of the most speculative sectors are perking up. (allstarcharts.com) Bitcoin hit its highest level since November 2021. (blockworks.co) Strategy Rubin Miller, "Investing on hopes and hunches — making emotional decisions — is why so few portfolios earn the actual market return." (fortunesandfrictions.com) The rise of passive investing hasn't broken the markets.

Speaker: Joe Buhrmann, MBA, CFP®, CLU®, ChFC® Senior Financial Planning Practice Management Consultant eMoney Advisor

During an era of evolving consumer preferences, the banking sector is undergoing a profound shift. As customers continue to broaden their perspectives, banking professionals must support their customers' financial wellness by providing holistic financial advice that aligns with individual goals and circumstances. Without adapting, financial institutions will find that loyalty may crumble amid uncertainty.

Wealth Management

FEBRUARY 28, 2024

Nesvold says she’ll certainly use her M&A know-how, but she’ll also play a larger role connecting the dots between Emigrant’s businesses—with the high-net-worth individual at the center of it all.

A Wealth of Common Sense

FEBRUARY 29, 2024

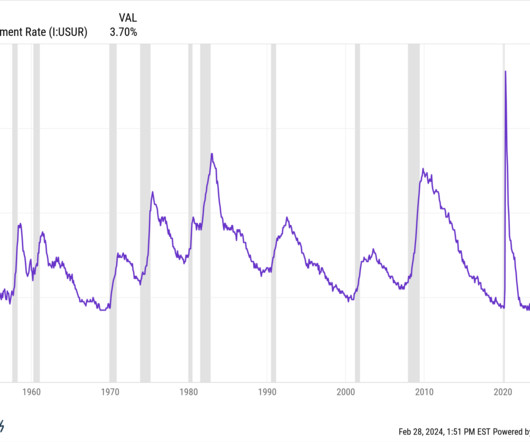

A reader asks: What’s the biggest risk in the markets right now? The simple answer here is the one everyone has been preparing for over the past 24 months — a recession. In the post-WWII era, the U.S. economy has slipped into a recession roughly once every 5 years or so, on average. Look at how spaced out those recessions (the grey bars) have become in recent decades: From the late-1940s through the early-198.

Calculated Risk

MARCH 1, 2024

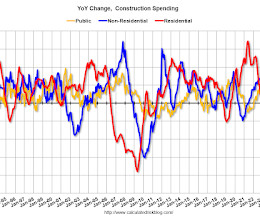

From the Census Bureau reported that overall construction spending increased: Construction spending during January 2024 was estimated at a seasonally adjusted annual rate of $2,102.4 billion, 0.2 percent below the revised December estimate of $2,105.8 billion. The January figure is 11.7 percent above the January 2023 estimate of $1,882.2 billion. emphasis added Private spending increased and public spending decreased: Spending on private construction was at a seasonally adjusted annual rate of $

Abnormal Returns

FEBRUARY 29, 2024

Book excerpts An excerpt from Rob Henderson's "Troubled: A Memoir of Foster Care, Family, and Social Class." (persuasion.community) An excerpt from Aaron Goldfarb’s new book “Dusty Booze: In Search of Vintage Spirits.” (wsj.com) An excerpt from "The Alternative: How to Build a Just Economy" by Nick Romeo. (behavioralscientist.org) An excerpt from “The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World’s Fastest-Growing Sport,” by Joshua Robinson and Jonathan Clegg.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Alpha Architect

MARCH 1, 2024

Be careful before acting on what is considered to be conventional wisdom. Make sure it’s supported by empirical evidence. In this case, the evidence makes clear that “cut your losses and let your profits run” should not be conventional wisdom. Cut Your Losses and Let Profits Run? was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

FEBRUARY 26, 2024

As donors and their tax advisors report 2023 charitable gifts, they should ensure compliance with the substantiation requirements to avoid questions about, and possible disallowance of, their charitable deductions.

Calculated Risk

FEBRUARY 27, 2024

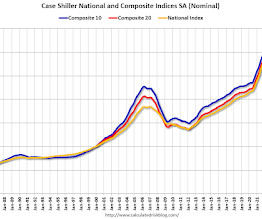

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3-month average of October, November and December closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Reports 5.5% Annual Home Price Gain for Calendar 2023 The S&P CoreLogic Case-Shiller U.S.

Abnormal Returns

MARCH 1, 2024

February 2024 A look at asset class performance for February 2024. (allstarcharts.com) Small cap stocks are still down on the year. (on.spdji.com) The momentum factor had a big month. (mrzepczynski.blogspot.com) Markets What's the biggest risk right now? (awealthofcommonsense.com) Stock market concentration is the norm. (acadian-asset.com) Crypto Bitcoin is now worth two Teslas ($TSLA).

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Advisor Perspectives

FEBRUARY 29, 2024

Personal income ( excluding transfer receipts ) rose 0.7% in January and is up 5.4% year-over-year. However, when adjusted for inflation using the BEA's PCE Price Index, real personal income (excluding transfer receipts) was up 0.3% month-over-month and 2.9% year-over-year.

Wealth Management

FEBRUARY 27, 2024

Non-traded alternative managers raised $7.6 billion in January, according to data from Robert A. Stanger. Retail investor activity helped drive the crypto market rally in January, says JP Morgan. These are among the investment must reads we found this week for wealth advisors.

Calculated Risk

FEBRUARY 29, 2024

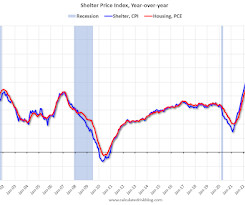

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through January 2024. CPI Shelter was up 6.1% year-over-year in January, down from 6.2% in December, and down from the cycle peak of 8.2% in March 2023. Housing (PCE) was up 6.1% YoY in January , down from 6.3% in December, and down from the cycle peak of 8.3% in April 2023.

Abnormal Returns

MARCH 1, 2024

The biz Google Podcasts is going away. (wired.com) Finance Joe Weisenthal and Tracy Alloway talks multi-strategy hedge funds with Krishna Kumar, a portfolio manager at Goose Hollow Capital Management. (podcasts.apple.com) Patrick O'Shaughnessy talks with Ali Hamed, co-founder and partner at CoVenture. (joincolossus.com) Barry Ritholtz talks concentrated portfolios with Andrew Slimmon, managing director at Morgan Stanley Investment Management.

Advertisement

Digital platforms can provide you with plenty of solutions, yet many are still intimidated by them. It's time to end that worry and embrace what could make a major difference for your bank. Understanding how they work and how to best utilize them for your banks is key toward success. In this article, Biz2X breaks down all things digital platforms, including the many advantages of embracing them.

Advisor Perspectives

FEBRUARY 26, 2024

Open-source software may well be the greatest “public good” the market economy has ever produced. What it shows is the power of voluntary social cooperation.

Wealth Management

FEBRUARY 26, 2024

The RIA entered a non-prosecution agreement with the Justice Department’s Antitrust Division last year over charges it conspired with American Century Investments not to hire each other's employees.

Calculated Risk

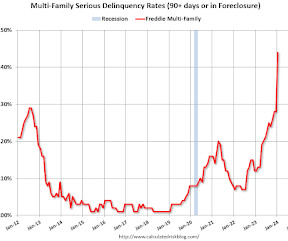

FEBRUARY 28, 2024

Today, in the Calculated Risk Real Estate Newsletter: Freddie Reports Surge in Multifamily Serious Delinquencies Brief excerpt: Freddie Mac reports that the multi-family serious delinquency rate increased sharply in January to 0.44% from 0.28% in December, and up from 0.12% in January 2023. This graph shows the Freddie multi-family serious delinquency rate since 2012.

Let's personalize your content