Inflation Is A Risk In Retirement, But Most Planning Technology Doesn’t Treat It That Way

Nerd's Eye View

SEPTEMBER 20, 2023

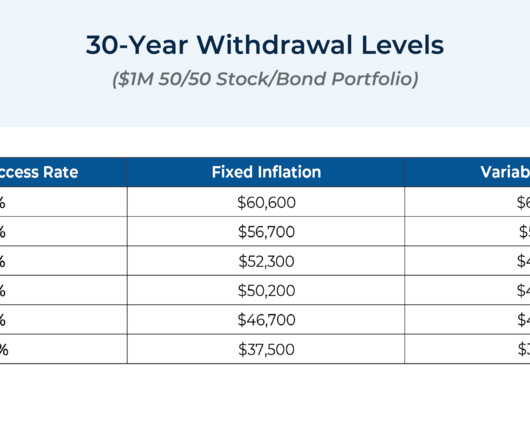

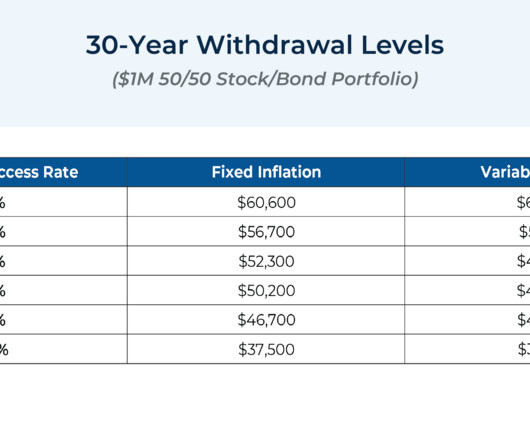

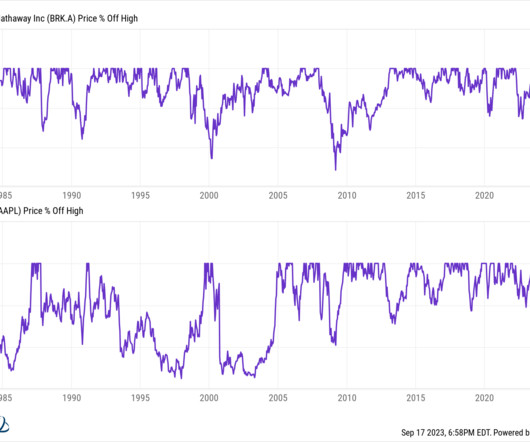

30 years ago, when financial plans relied mainly on constant investment return projections derived from straight-line appreciation and time-value of money calculations, financial advisors began acknowledging and accounting for the variable and uncertain nature of investment returns. And by turning to tools that incorporated historical or Monte Carlo simulations, advisors were able to examine the potential impact of sequence-of-return risk on an investor's portfolio, modeling those risks across h

Let's personalize your content