The Billionaires Income Tax Act and the Moore Case

Wealth Management

JANUARY 11, 2024

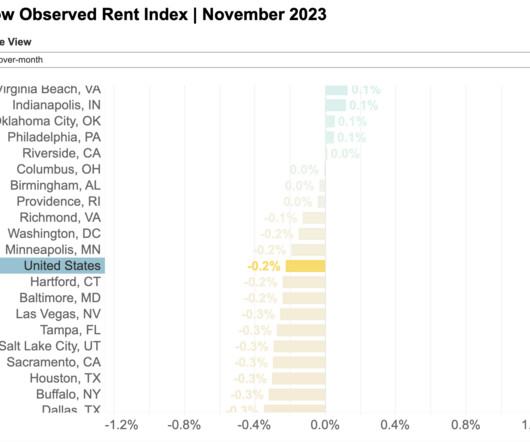

The ongoing case before the Supreme Court, which questions the constitutionality of taxing unrealized capital gains, holds significant implications for the future of wealth management.

Let's personalize your content