Literally

The Reformed Broker

AUGUST 22, 2022

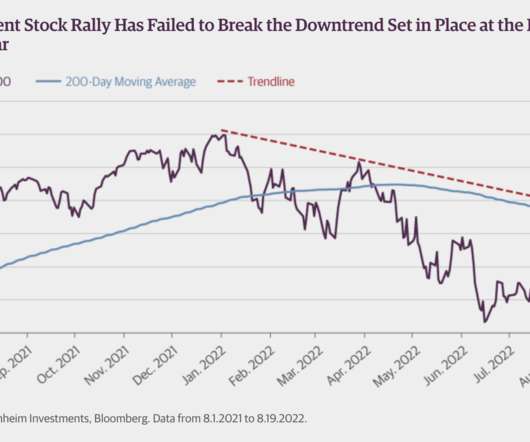

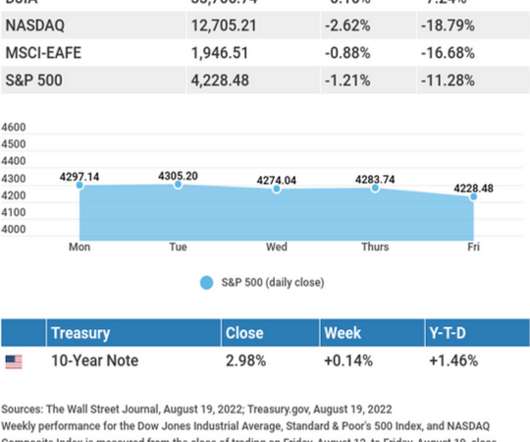

Sharing this chart from Guggenheim showing that the S&P 500’s bear market bounce literally stopped on a dime and was turned away at the 200-day moving average. It’s almost too perfect. We manage our tactical portfolio based on technically-oriented rules not because it always works (it doesn’t!) but because it eliminates feelings like fear or fear of missing out from the decision-making process.

Let's personalize your content