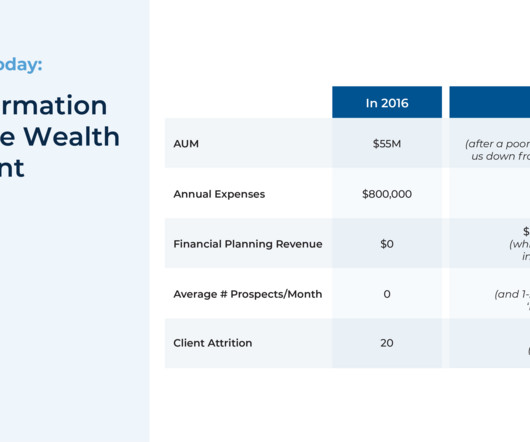

From Unprofitable To $115M AUM: Reinventing A 2nd Generation Advisory Business By Finding The Right Niche

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family. At the same time, the business strategies that worked for the original owner might not be suitable or as successful for their successor, which can force the 2nd-generation owner to take a different path to ensure the firm

Let's personalize your content